Rumors swirl around $100k/hr front running on Binance listings

On February 17th, the wallet that was kept Before Engaged in front-running token listings on Binance, he made another deal. This time, he bought and sold Gaines (GNS) tokens just before listing on the world’s leading exchanges.

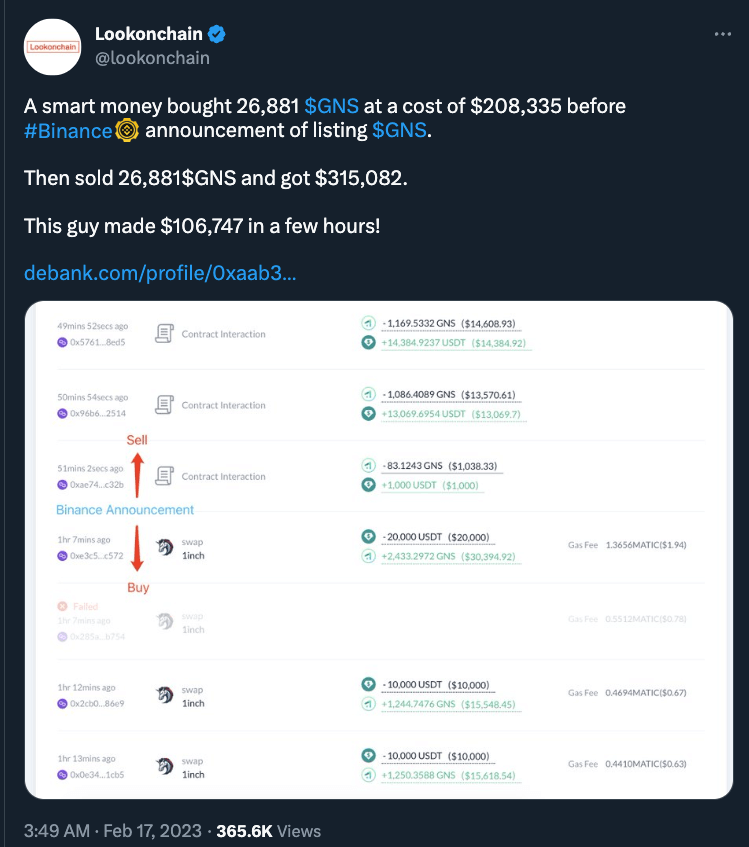

According to an analysis by look on chaina crypto trader who remains unidentified made a profit of over $100,000 by buying the token just minutes before it was listed on Binance.

An on-chain investigation found that traders had bought $208,335 worth of Gains Network (GNS) tokens just 30 minutes ago, just before it was listed on Binance. After listing, GNS rose 51% from his $7.92 to $12.01 and the trader sold his GNS holdings making him a profit of $106,747.

Lookonchain sarcastically referred to the transaction as “smart money” in a Twitter post. However, few people find it funny because insider trading is legal in most countries, including the United States, Canada, the European Union, and many other jurisdictions around the world. Trading based on non-public information, such as information about pending listings, is generally considered fraudulent and may compromise the integrity and fairness of the market.

What is front running

In the context of crypto exchanges, front running can occur when a trader or exchange employee uses sensitive information about a customer’s trade to place his/her own trade before the customer’s trade is executed. . This can bring profits at the expense of the customer.

Front-running gives those who engage in it an unfair advantage in the market. It is also a breach of trust because it violates any confidentiality obligations that may exist between the person with insider information and the other parties involved in the transaction.

Over the past year, a number of prominent cryptocurrency exchanges have seen a front-running trend in which traders with insider knowledge take key positions, often in tokens that are likely to appreciate in value because they are listed. We have faced scrutiny of suspected and confirmed cases. Centralized crypto exchanges such as Binance.

Frontrunning on coinbase.

recently caseformer Coinbase product manager Ishan Wahhi pleaded guilty to participating in an insider trading scheme that generated $1.1 million in profits. It was deemed an insider trading incident.

August 2022, 1 person academic research According to the report, 10-20% of CoinBase’s new cryptocurrency listings were front-running.

Binance CEO Responds to Frontrunning, Says Most Happens on Token Side

In July, when Wahi was first indicted, Binance CEO Changpeng Zhao (CZ) denounced the actions of Coinbase employees, stating that “insider trading and frontrunning should be crimes in any country. ‘ said. Is it cryptocurrency or not.

Binance claims to have implemented a self-regulatory policy that prohibits employees from engaging in short-term trading. But his Wahi at Coinbase, for example, shared insider information about the tokens about to be listed with his brothers and friends, which led to prosecutions.

At a recent AMA, CZ said that much of the leaks and frontruns came from the project/token side, not from within Binance. Binance has made it clear that anyone who tries to act before the news of being listed on Binance will be blacklisted.

“We try not to tell the project team when they will be listed on Binance as much as possible. And news, sometimes news leaks on the project side, so I want to prevent that as much as possible, it’s not 100% but it works better than most other exchanges I think I do.”