A deep dive into the implications of the lawsuit and its effects on stablecoins

Paxos faces SEC lawsuit over BUSD

On February 13, the U.S. Securities and Exchange Commission (SEC) Enforcement Division issued a Wells Notice to Paxos, ordering the company to stop issuing the Binance USD (BUSD) stablecoin.

The notice follows an SEC investigation into the relationship between Paxos and the Paxos-issued stablecoin Binance, which concluded that the company violated securities laws. However, Wells’ notice does not necessarily mean that the SEC will take enforcement action against Paxos. For the SEC to pursue this issue further, her five SEC commissioners will need to vote to approve a mandatory lawsuit or settlement.

according to news, the Department of Financial Services (DFS) ordered Paxos to stop issuing BUSD due to “several unresolved issues related to Paxos’ oversight of its relationship with Binance.” There was no further explanation for these issues — Binance CEO Changpeng Zhao said: Said He was only aware of enforcement actions through the media.

Paxos plans to file a response to Wells’ notice explaining why it cannot be sued. In the meantime, the company should stop issuing new her BUSD and allow all customers to convert her BUSD into US dollars.Paxos is maintained All BUSD tokens are backed 1:1 with USD denominated reserves at all times.

BUSD is the only stablecoin backed by long maturity assets

But these dollar-denominated reserves are far from the norm. Paxos unaudited BUSD holdings report It shows that stablecoins are primarily backed by long maturity assets. On Feb. 10, the company’s report showed 16.14 billion unpaid BUSD tokens with an equal or greater balance of assets in custody.

Just under $3.1 billion of short-term US Treasury bills will mature by mid-April 2023.

On February 10, $12.5 billion of Paxos’ $16.4 billion BUSD reserves were held in reverse repurchase agreements with the US Treasury. Only two of his repurchase agreements will mature in 2023 and his 2024, with the rest of his $12.5 billion maturity dates from He 2026 to He 2052.

$1 Billion Worth of Stablecoins Leave Ethereum

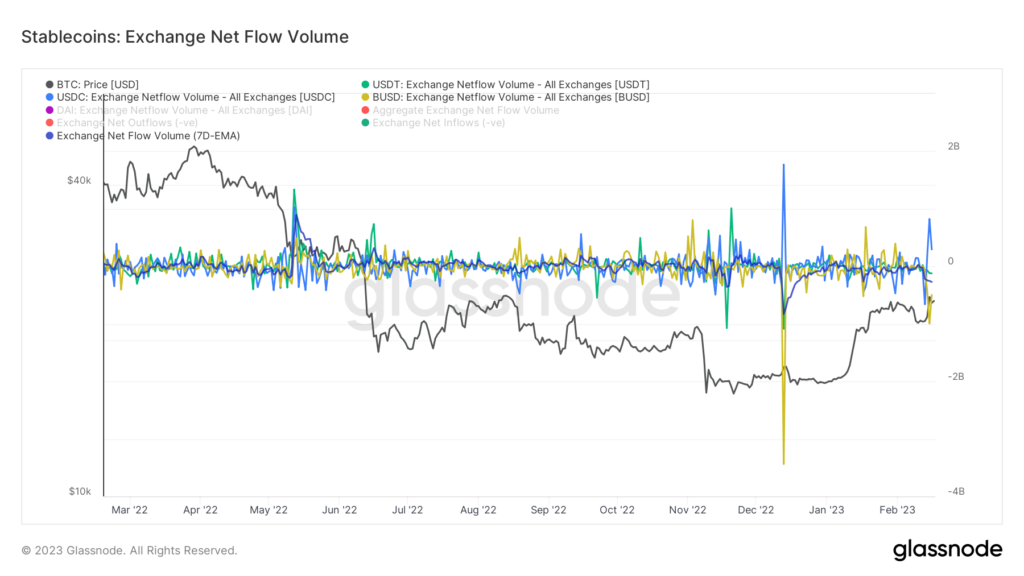

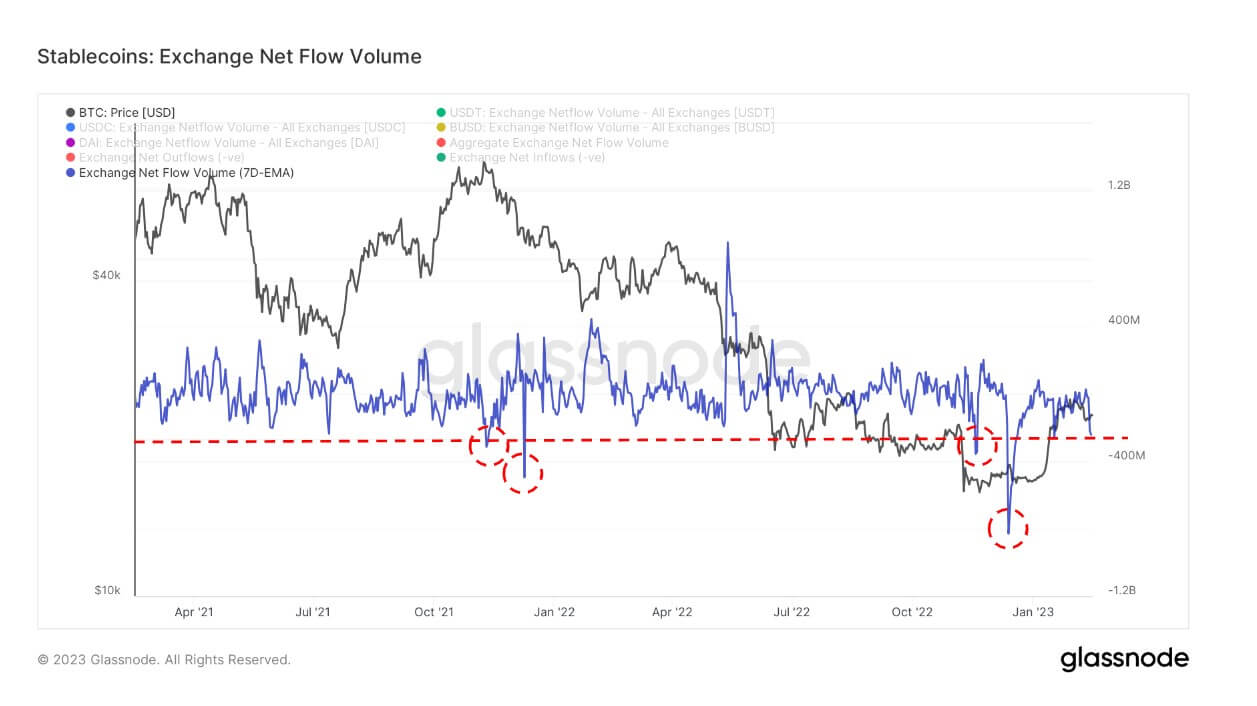

The scrutiny against BUSD has triggered unprecedented FUD in the market. This was evident in the massive outflow of stablecoins from exchanges. Since February 13th, over $1 billion in various stablecoins have leaked from the Ethereum network.

Most of this loss can be attributed to BUSD, which confirmed the total number of outstanding tokens. Descent About 700,000 people increased from February 10th to February 14th.

This is the fifth largest stablecoin outflow on Ethereum in the last two years. His $271 billion outflow, recorded on Feb. 16, is only a fraction of his $830 billion recorded on Dec. 13, but the SEC’s probe into Paxos still gives the market showing the impact.

BUSD Sees Its Dominance Decline

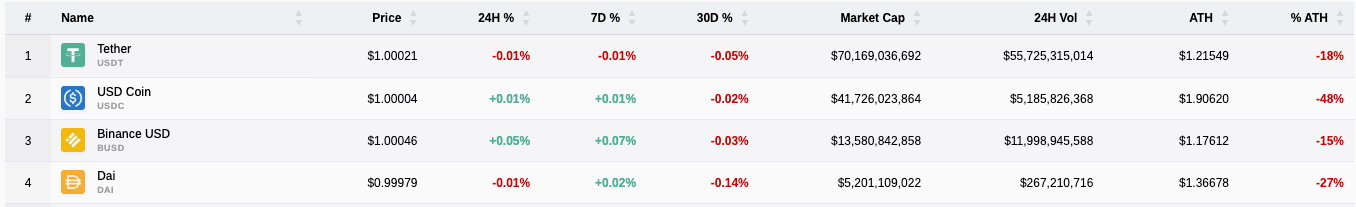

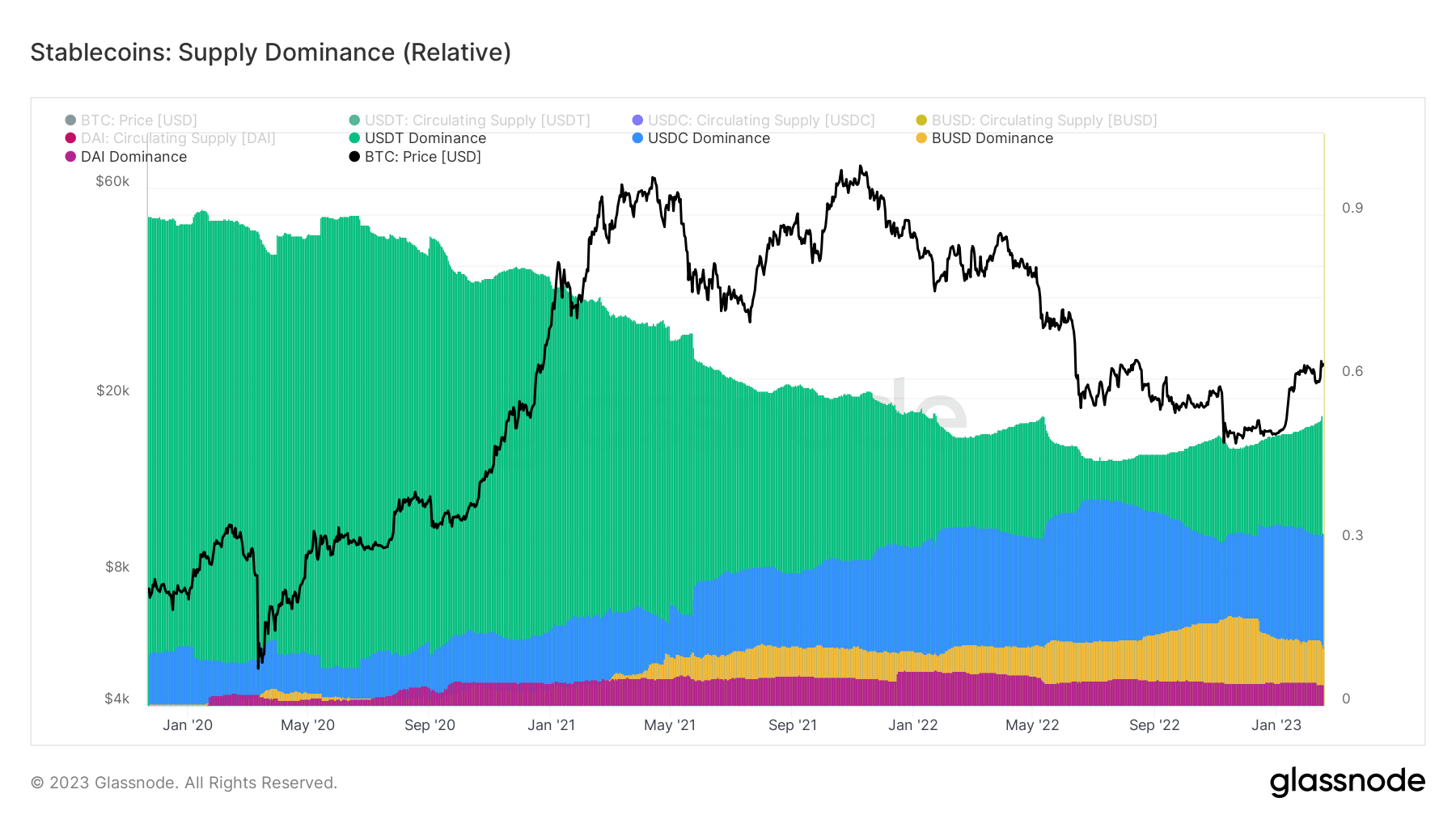

As the third largest stablecoin by market capitalization, the change in volume BUSD experience will have a significant impact on the rest of the stablecoin sector. The coin’s dominance has dropped from 17% recorded in November 2022 to 12% on February 14th.

The same is true for top-ranked stablecoins USDC and DAI, both of which have seen a decline in market power since the beginning of the year.

A reverse trend can be seen in USDT. The Tether stablecoin has increased its dominance since November 2022, surpassing 53% on February 15, 2023.

Binance CEO Changpeng Zhao said: Said Due to the SEC order against Paxos, the market cap of BUSD will decrease over time. Paxos will continue to service the product, but the market expects the redemption will continue to further deplete his BUSD supply, pending a decision from the SEC.

Until then, USDT’s market cap and sector dominance may continue to grow. USDT, the largest stablecoin by market cap, has already seen notable inflows since the SEC investigated Paxos.

The Tether stablecoin saw a significant increase in liquidity on Binance last September when the exchange delisted USDC, USDP and TUSD denominated pairs from the platform. The move was intended to improve price discovery and overall liquidity on the exchange. However, many see this as Binance trying to achieve vertical integration, and most of its trading pairs (and the most liquid ones) were tied to his BUSD.

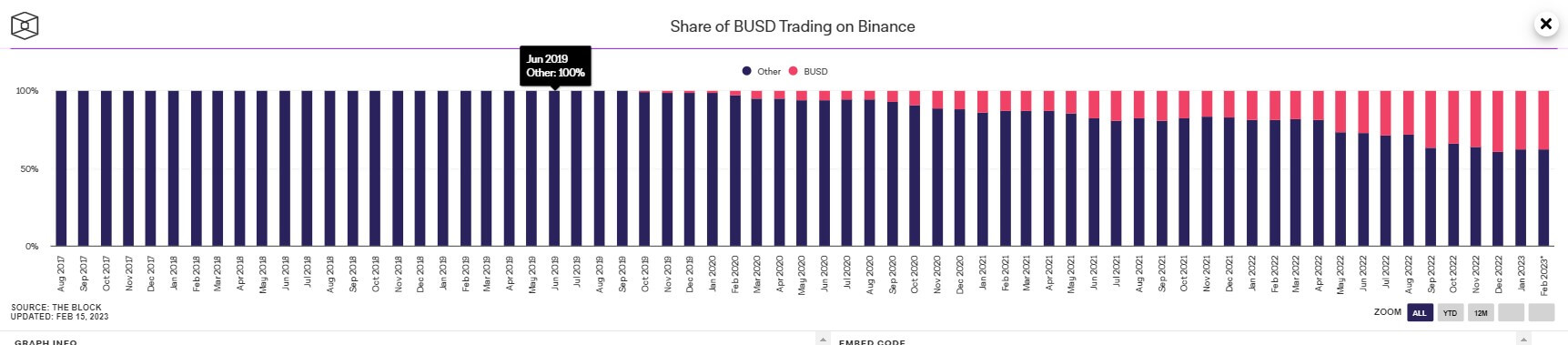

The share of the BUSD pair on Binance has steadily increased since its inception in late 2019, but has seen a notable increase since the exchange delisted USDC, USDP, and TUSD.

As BUSD’s market capitalization declines, we expect the BUSD pair’s share of the exchange to drop even further. Also, while there has been no noticeable increase in the share of USDT pairs on exchanges, it could increase by the end of the quarter.

Binance Issues With Maintaining Stablecoin Peg Reserves

The SEC enforcement action against Paxos is set to hurt Binance. The SEC notice cites Paxos’ relationship with the exchange as the reason behind the execution. And while Binance is not US-based and therefore not subject to US regulation, targeting BUSD has certainly shaken market confidence in the exchange.

Binance has been under intense scrutiny since witnessing a historic withdrawal in November 2022 following the collapse of FTX. In January this year, the exchange admitted that it had failed to maintain reserves for Binance-peg BUSD, a stablecoin it issues on other blockchains.

According to data compiled by blockchain analytics firm ChainArgos and analyzed by Bloomberg, Binance-peg BUSD was frequently undercollateralized in 2020-2021. The gap between his BUSD reserves held by Binance and the supply of Binance-peg BUSD exceeded $1 billion on three separate occasions. .

The exchange has acknowledged past problems in maintaining reserves of Binance-peg BUSD, and has since said it has improved its process with enhanced discrepancy checks so that tokens are backed 1:1 with BUSD. I’m here.

BNB Begins Slow Recovery

Binance’s native token, BNB, has not been affected by the Paxos news.

The price of the token fell by more than 11% within 24 hours as investors considered the possibility of increased regulatory scrutiny of Binance. However, the drop in confidence appears to have been short-lived, as BNB recovered most of his losses on Feb. 16 and he has risen more than 9% since the Feb. 13 news.

Conclusion

The full impact of the SEC’s investigation into Paxos is yet to be felt.

If the SEC decides to take enforcement action against Paxos and take it to court for securities law violations, the market could enter a period of unprecedented volatility. Many analysts argue that BUSD has failed the Howey test, a set of criteria set by the SEC to determine whether an asset is classified as a security. If the European Commission continues to pursue this issue in court, it could set a precedent for the rest of the crypto industry and threaten all other major stablecoin issuers.

Increased regulatory uncertainty could destabilize a market that is just beginning to slowly recover from the FTX collapse. It could also dramatically change the crypto landscape in the United States, as many companies may seek to take root in a more regulatory-friendly environment.