Sentiment among Bitcoin and Ethereum options traders flips bullish

Glassnode data analyzed by crypto slate Significant increase in Bitcoin and Ethereum open interest calls.

Calls and puts refer to buying and selling options respectively. These derivative instruments give the holder the right, but not the obligation, to buy or sell the underlying asset at a specified price at some point in the future.

This predetermined price is also called the strike price. Together with the spot price, it determines the “monetary value” of the option.

A call with a strike price below the spot price is “in the money” because it allows the trader to buy the option below the market price and sell it immediately. Similarly, a put with a strike price above the spot price is “in the money” because it allows the trader to sell the option above the market price.

“Out of the money” occurs when a call strike price is above the market price or a put strike price is below the market price.

The spread of calls and puts at various strike prices provides a general measure of market sentiment while also providing information about traders’ expectations of future prices.

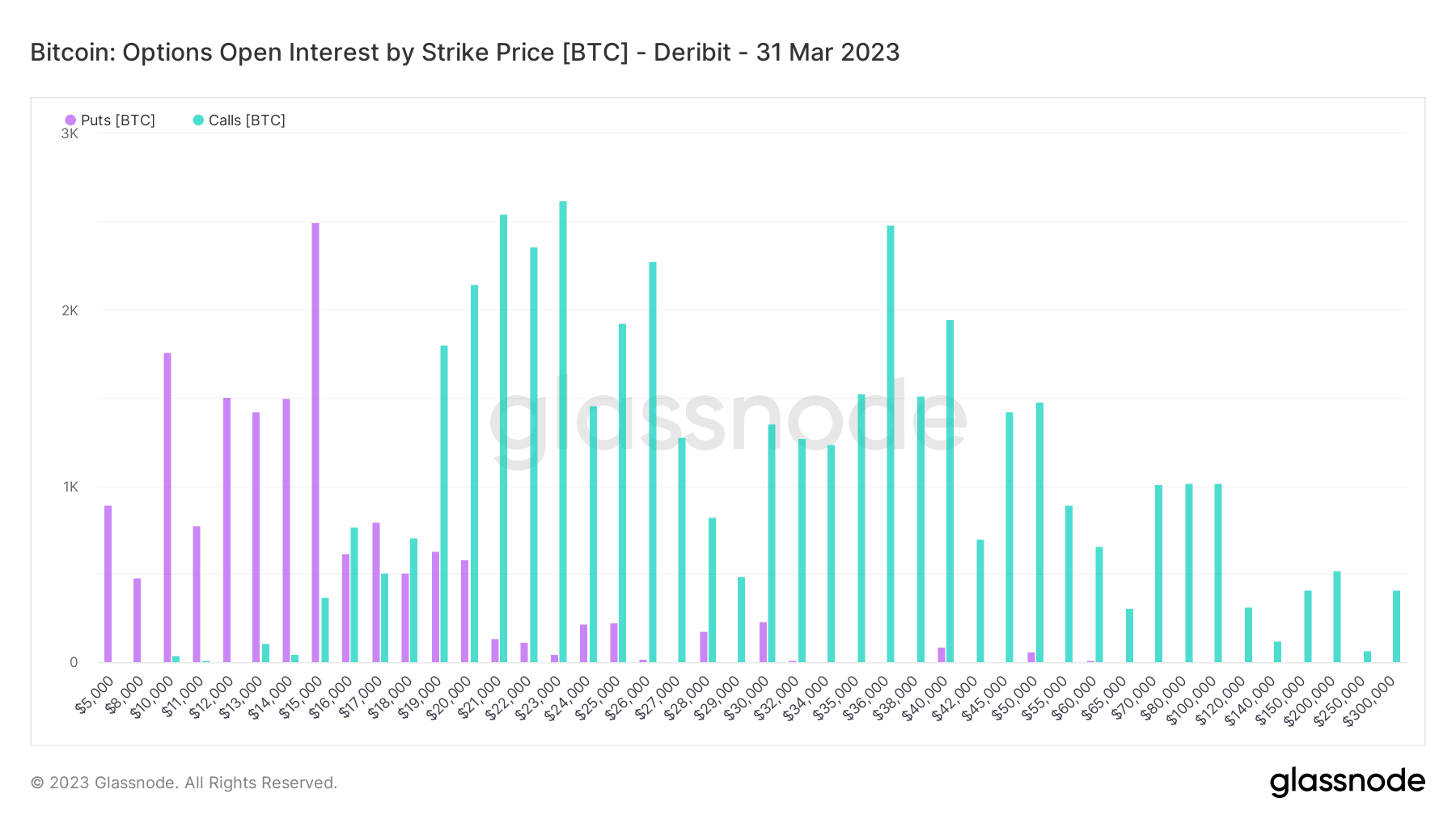

bitcoin open interest

Bitcoin’s open interest in Q1 2023 has significantly more calls than puts according to strike prices, suggesting bullish sentiment among option traders is on the rise.

Bitcoin is favored in the $15,000-$20,000 range, with calls and puts roughly even. This is expected given that BTC has traded within this popular price range since the FTX collapse.

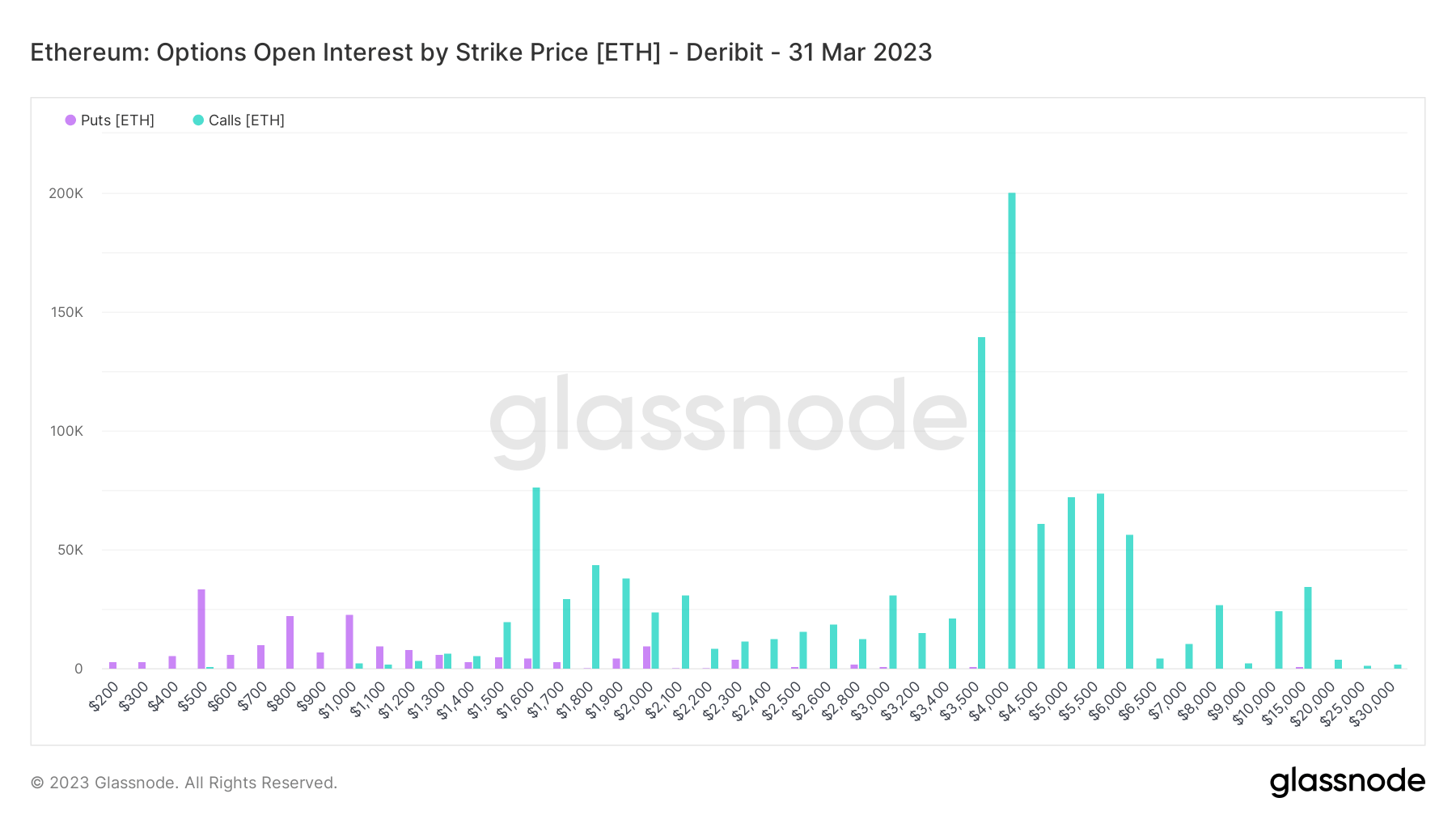

Ethereum Open Interest

Ethereum open interest by strike price in Q1 2023 showed a clear dominance of the call, adding to the bullish sentiment narrative.

Ethereum is generally considered to have a higher beta than Bitcoin. However, in a risk-off environment this may not be the case.

The most significant calls were noted to be $3,500 and $4,000 at $150,000 and $200,000 respectively.

As the first week of 2023 draws to a close, uncertainty remains the overriding theme. Further macro headwinds could exacerbate crypto stagnation and disappoint options traders.