Short-term Bitcoin holders signal positive market momentum as BTC breaks $30K

On June 21st, bitcoin crossed the $30,000 mark for the first time in two months, showing signs of renewed vigor in the cryptocurrency market.

The rally generated more than $228.8 million in short-term liquidations within 24 hours, of which Bitcoin accounted for $110.5 million. Bitcoin’s resurgence above the $30,000 threshold could signal an upcoming rally, which is reflected in on-chain data, especially short-term holder behavior.

A short-term holder (STH) is an investor who holds crypto assets for less than 155 days. Their behavior is sensitive to recent price movements, which makes them very important in market analysis and a reliable indicator of market momentum.

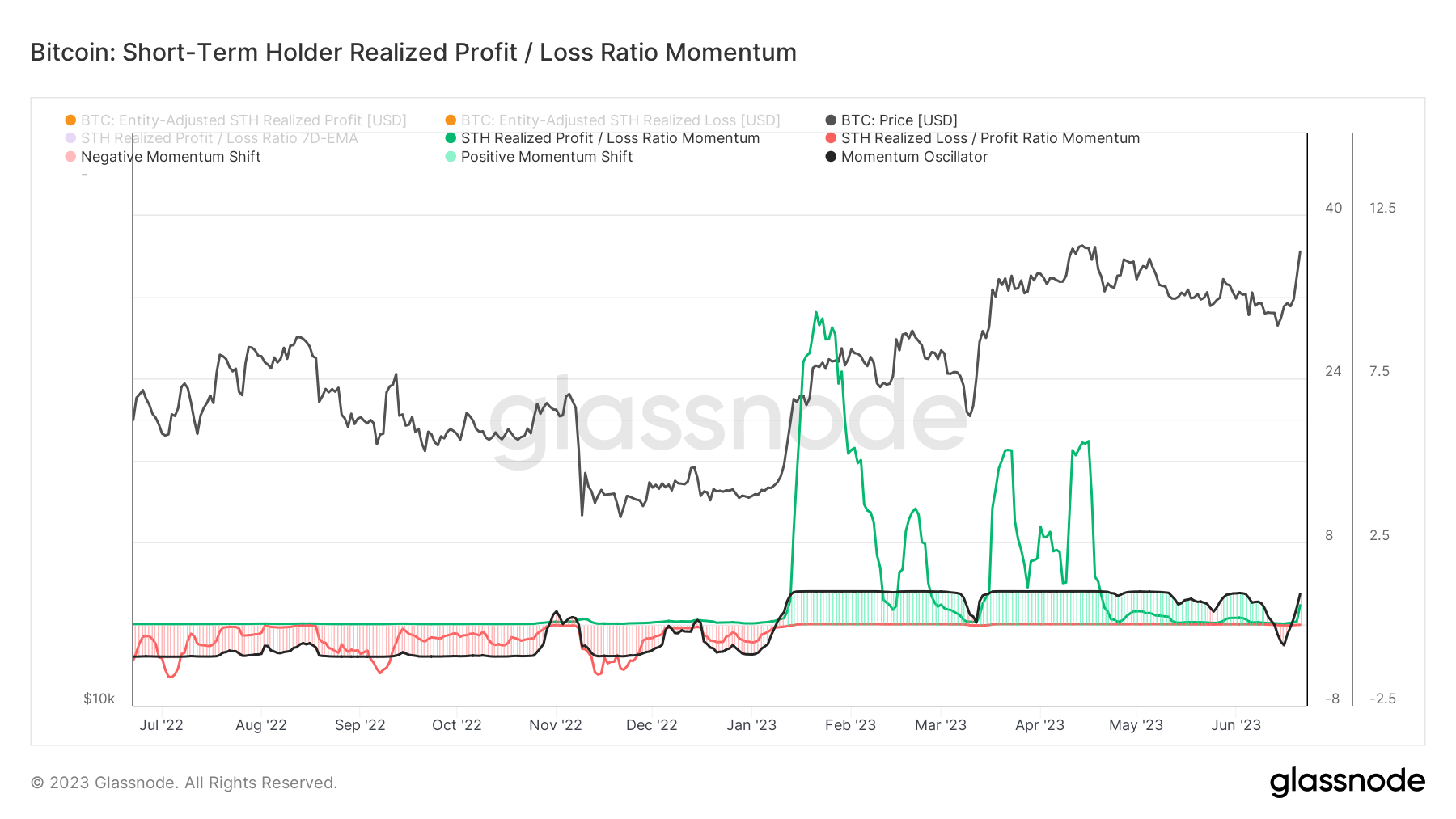

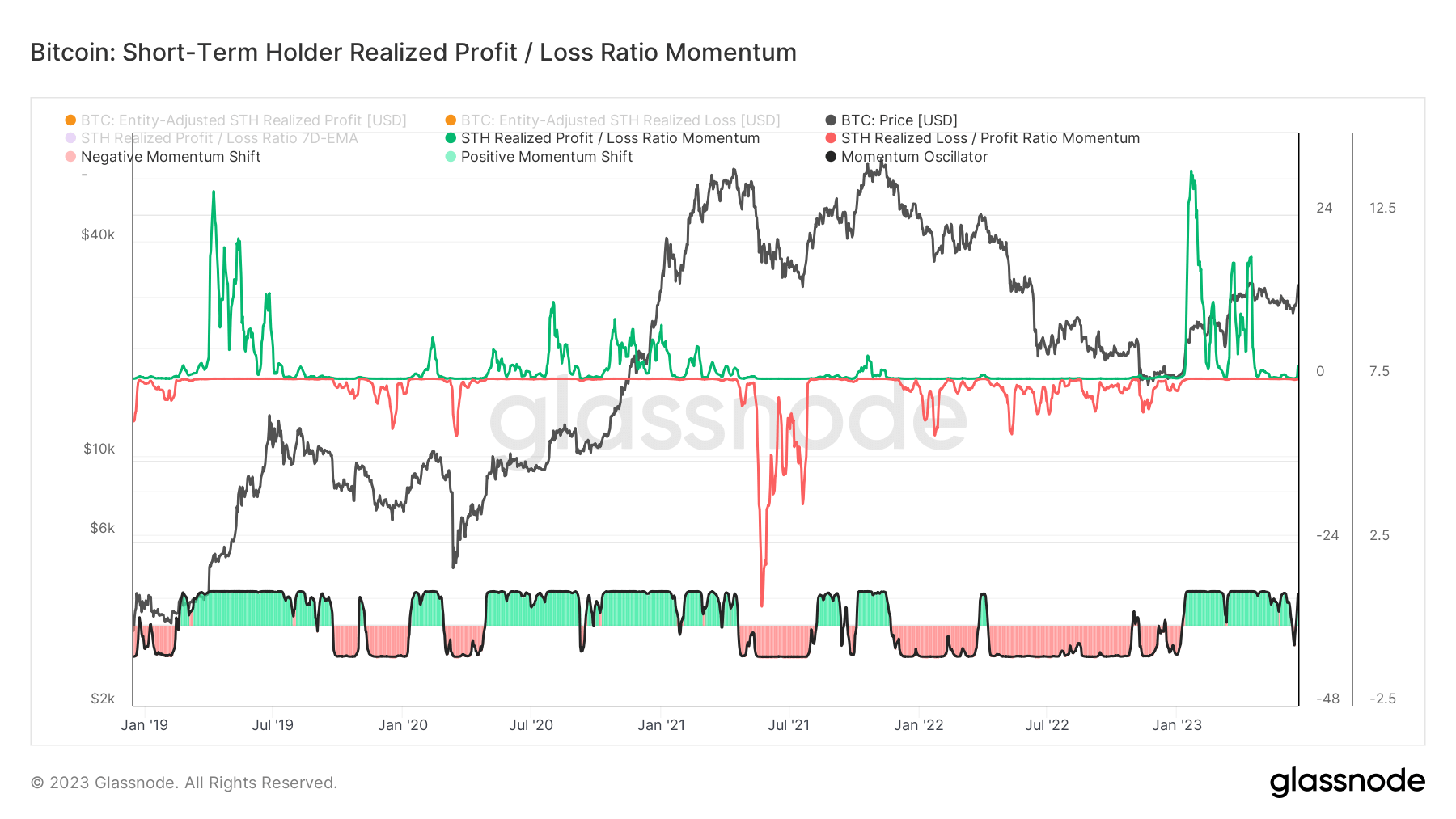

A CryptoSlate analysis based on Glassnode data showed a positive change in the short-term holders realized profit/loss (STH RPL) ratio, a key metric in understanding market dynamics.

The STH RPL ratio, along with its one-year moving average, can help identify trend inflection points by capturing periods when the PnL ratio is accelerating in either direction.

The profit/loss ratio is calculated by dividing the value of coins sold at a profit by the value of coins sold at a loss. In this case, within the short-term holding period of 155 days. This indicator reflects how the STH is responding to recent price movements and provides an indication of current market sentiment among new investors.

STH is typically active throughout the market cycle and is statistically the most responsive to market volatility. Owners of recently traded or acquired coins may have some degree of recency bias with respect to their coin’s cost criteria. Therefore, a price rise or fall below that level is more likely to elicit a reaction.

Net worth transfers often occur in extreme local market conditions as investors take profits near highs and capitulate near lows. This capital turnover usually leads to an increase in the share of wealth held by STHs, making them the dominant population observed after these events. Tracking changes in STH momentum realizing profit and loss could indicate that the macro market trend is at an inflection point.

During market upswings, realized gains accelerate as STH, which recently acquired the coin, gains. Conversely, realized losses accelerate during market corrections, causing recently acquired STH to lose money and cause panic.

Historically, a sharp rise in STH P&L momentum has marked the beginning of a bull market, and a sharp decline in momentum has marked the beginning of a bear market. The recent positive change in the STH RPL ratio, coupled with Bitcoin’s surge above $30,000, could indicate a new phase of bullish momentum in the market.

A post first appeared on CryptoSlate that short-term Bitcoin holders are showing positive momentum in the market as BTC surpasses $30,000.