Significant distribution in the Bitcoin network from all cohorts – similar pattern occurs after bear market bottoms

meaning

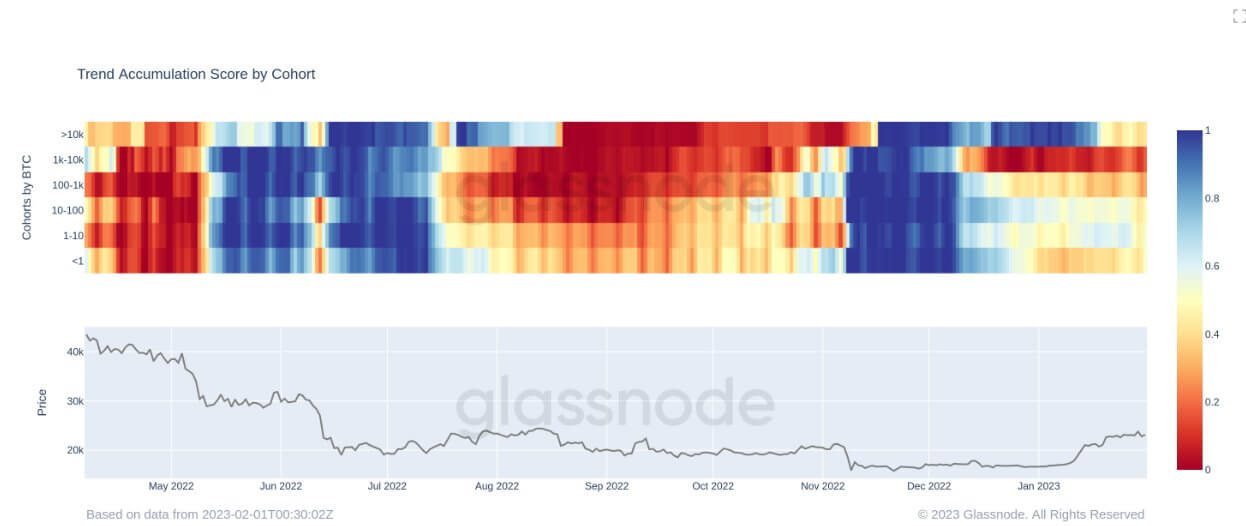

Accumulation Trend Score (ATS) is a metric that reflects the relative size of entities actively accumulating coins on-chain with respect to BTC holdings. The ATS scale represents both the size of an entity’s balance (participation score) and the amount of new coins acquired/sold in the last month (balance change score).

An ATS close to 1 indicates that the larger entities (or most of the network) are accumulating as a whole, while a value close to 0 indicates that they are dispersed or not accumulating. This provides insight into market participants’ balance sizes and their accumulation behavior over the last month.

quick take

- The Bitcoin (BTC) network is now massively distributed from all cohorts. This behavior was last seen after Luna’s collapse in mid-2022.

- This is because all cohorts found great value in the BTC price after aggressive buying during the November 2022 FTX collapse.

- The same behavior occurred after bear market troughs in 2015, 2019, 2020 and 2022. Distributions will start to occur once the investor makes a profit, but may become reluctant to continue accumulating if the investor expresses fear of a bull trap.

Cumulative Propensity Score: (Source: Glassnode)

Cumulative propensity scores by cohort: (Source: Glassnode)

A significant distribution in the Bitcoin network from all cohorts – a similar pattern occurs after the initial bear market bottom appears on CryptoSlate.