The Bearish case for Bitcoin as 2022 ends

In perhaps the coldest winter in Bitcoin history, the pRice has fallen more than 70% from its all-time high on Nov. 10, 2021 $69,044.77its market capitalization fell from an annual high of $902.04 billion to $318.943 billion, down 64.64%.

Let’s take a look at some indicators that give us a deeper understanding of the current Bitcoin bear market.

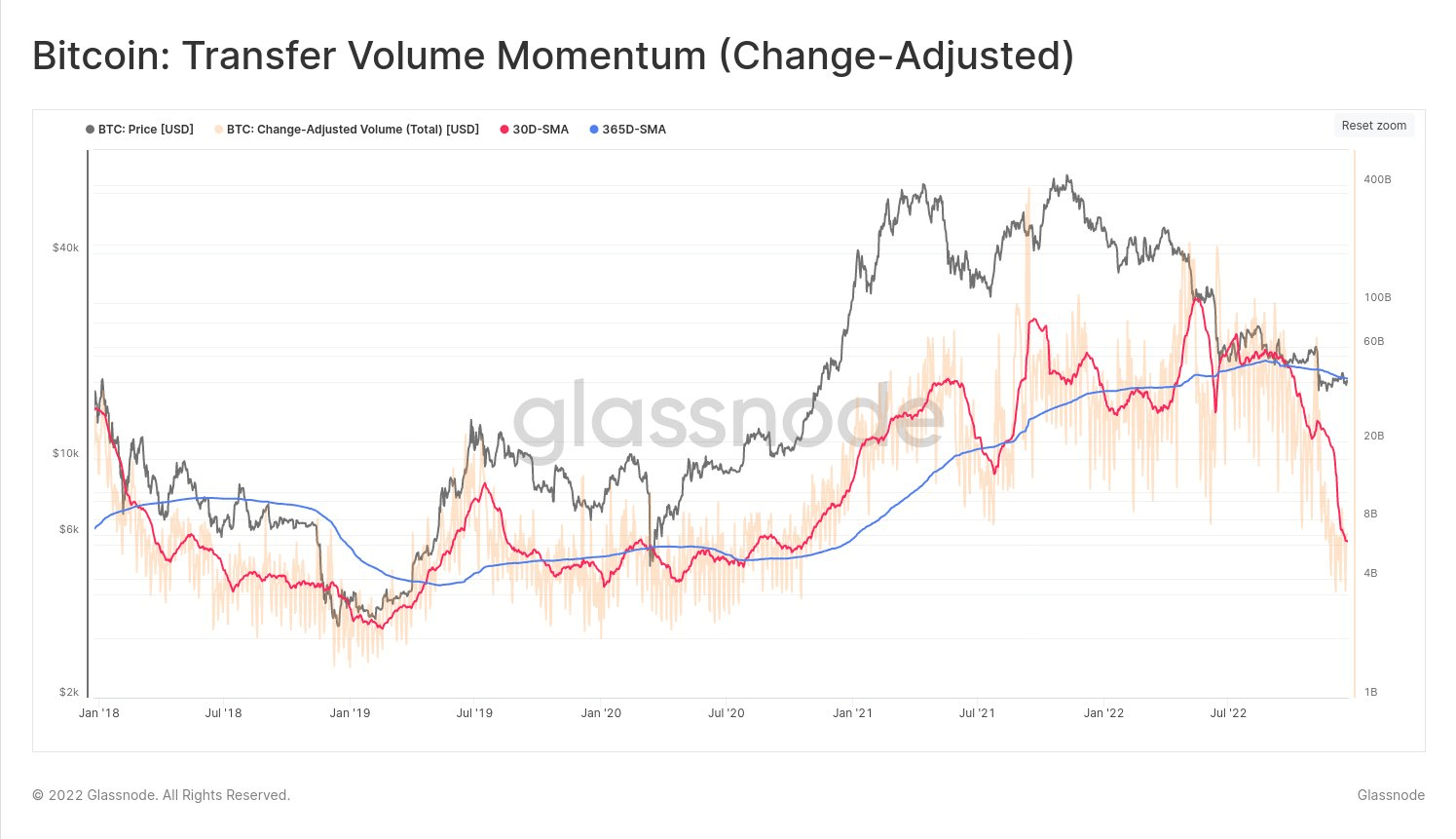

transfer volume momentum

Prior to June, BTC’s 30-day moving average (DMA) (red line) was at a record high in terms of transfer volume, but after the Lunaterra crash, it declined rapidly and is now at new lows.

Bitcoin Network Transfers shows the current level of network activity and the value being transferred in BTC and USD. This metric compares monthly averages (red line) to yearly averages (blue line) to highlight relative changes in prevailing sentiment and identify when the tide of network activity changes. help.

It is common for 30 DMA to be below 365 DMA in bear markets and vice versa in bull markets. According to data analyzed by CryptoSlate, 30 DMA is now below 365 DMA, indicating weaker network fundamentals and lower network utilization.

This indicates that the momentum has evaporated in terms of chain transfer which is worrisome. This is also the largest discrepancy between 30 DMA and 365 DMA in the last five years.

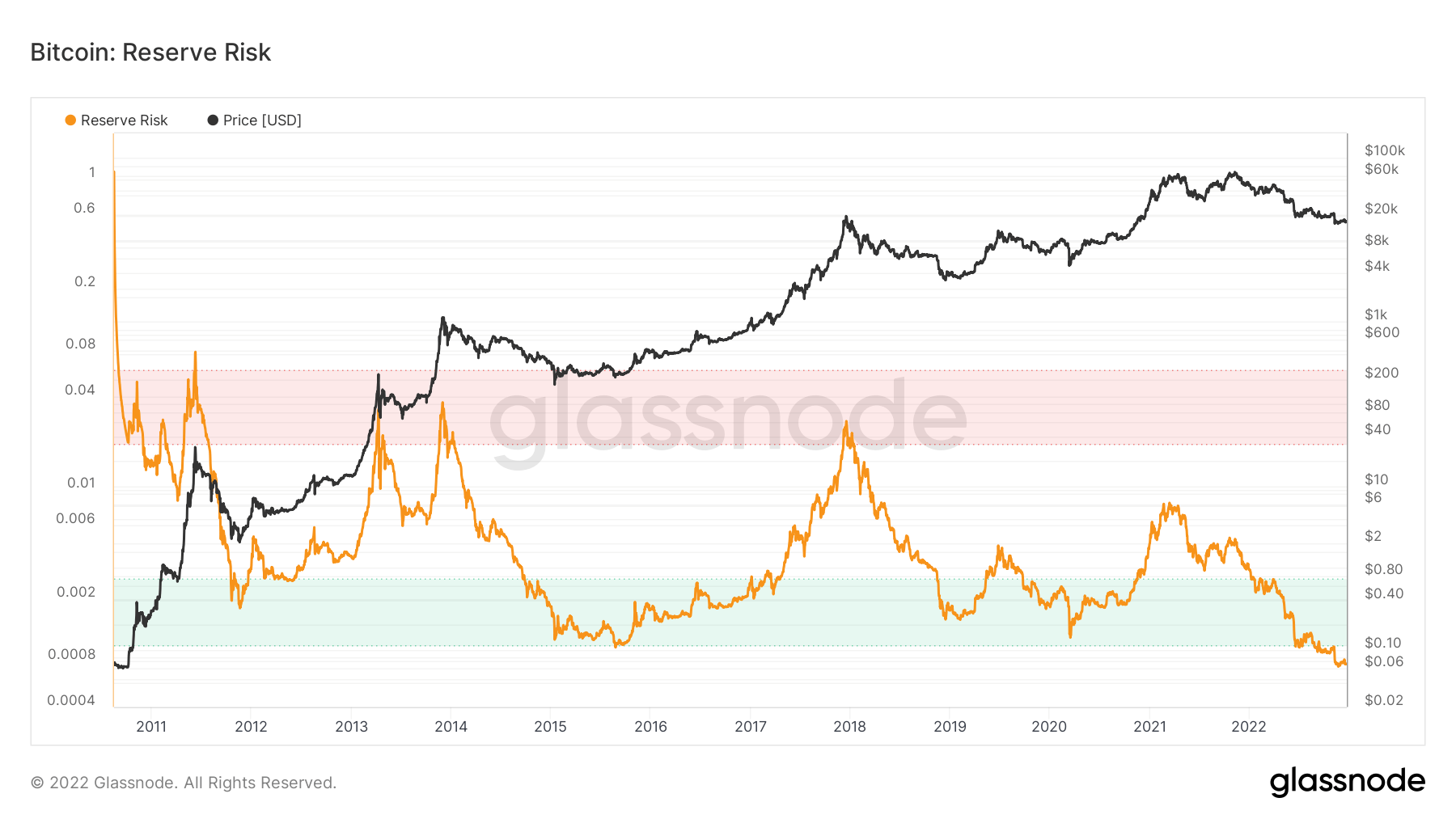

Bitcoin reserve risk

CryptoSlate’s on-chain analysis shows the Bitcoin Reserve Risk indicator has dropped to an all-time low.

The Bitcoin Reserve Indicator measures the level of long-term holders’ confidence in the current Bitcoin price. Reserve risk is the ratio of the current price (the incentive to sell) to his HODL bank. The HODL Bank metric represents the cumulative opportunity cost of holding an asset.

When the Bitcoin price reaches record highs, reserve risk (red zone) tends to increase, reflecting declining investor confidence.

Alternatively, a lower Bitcoin price and higher confidence means less reserve risk (green zone) or an improved risk/reward ratio.

But at the moment, Bitcoin reserve risk is outside the green box for the first time ever, indicating a lack of investor confidence.

Nevertheless, the low reserve risk is signal Relatively underestimated, this can be a lengthy process.

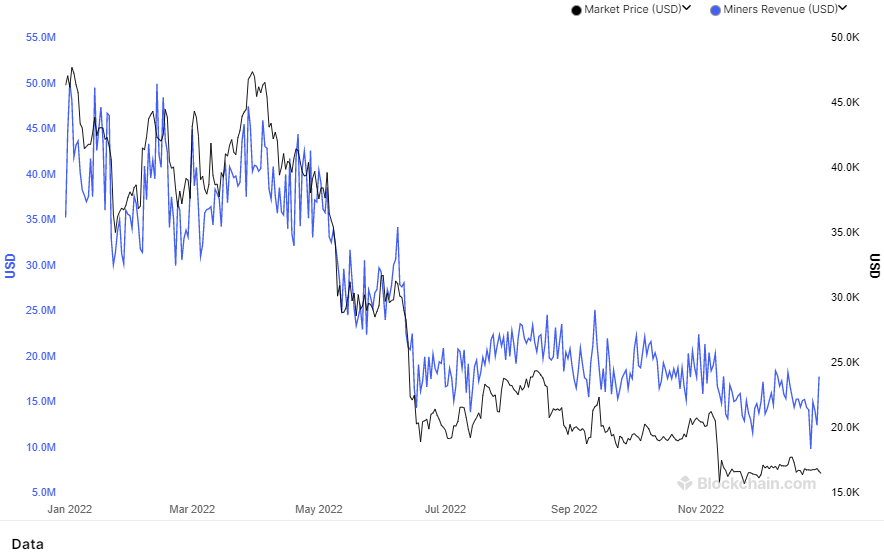

Bitcoin miner earnings

Bitcoin miner daily revenues have been declining for over a year, plunging to new lows due to a market downturn and increased computational demand.

As a result, mining companies such as Core Scientific have filed for bankruptcy and several Miners also suffer.Furthermore, according to a previous article report According to CryptoSlate, miners are selling their coins at the highest rate in the last two years, making it difficult to adjust negatively as a result.

On the other hand, the BTC miner wallet balance is Dropped to levels seen in January 2022, according to data analyzed by CryptoSlate.

Mark Mobius, co-founder of Mobius Capital Partners, accurately predicted a drop to $20,000 this year. Bitcoin falls far short of $10,000 We’ve passed the $17,000 and $18,000 tech support levels.

If Mobius’ $10,000 call materializes, the cryptocurrency market will be even more dire.

However, Bitcoin sentiment is not completely bearish in 2022. For example, the number of long-term Bitcoin holders is record all-time high this year.