The European sovereign debt crisis 2.0

Despite their best efforts, European governments have so far failed to contain inflation this year. Russia’s invasion of Ukraine was the spark that finally triggered the crisis that has been looming since the outbreak of her COVID-19 pandemic in 2020.

In June, EU member states released their Consumer Price Index (CPI), showing a significant increase in prices from the figures released in June. Spain posted a 10.8% rise in CPI and Belgium is closing in on her 10.4% rise. CPI increased by 9.3% and 9.1% in Austria and Portugal, and by 8.5% and 8.4% in Germany and Italy. France’s CPI rose 6.1% from June’s figure.

To combat rising inflation, the European Central Bank (ECB) has raised three key interest rates by 50 basis points. Interest rates on key refinancing options and marginal facilities were raised to 0.50% and 0.75%, the first time the ECB has hiked rates since his 2011.

ECB President Christine Lagarde said higher interest rates would put downward pressure on prices and help the ECB cut inflation to 2%. But Lagarde’s plan will only work if energy costs stabilize, supply bottlenecks are eased, and “there are no new disruptions.”

So far, rapidly declining real interest rates will only pose problems for the Eurozone. With winter approaching, energy prices are starting to rise significantly in the EU, and some countries are actively planning intermittent power outages in the fall and winter.

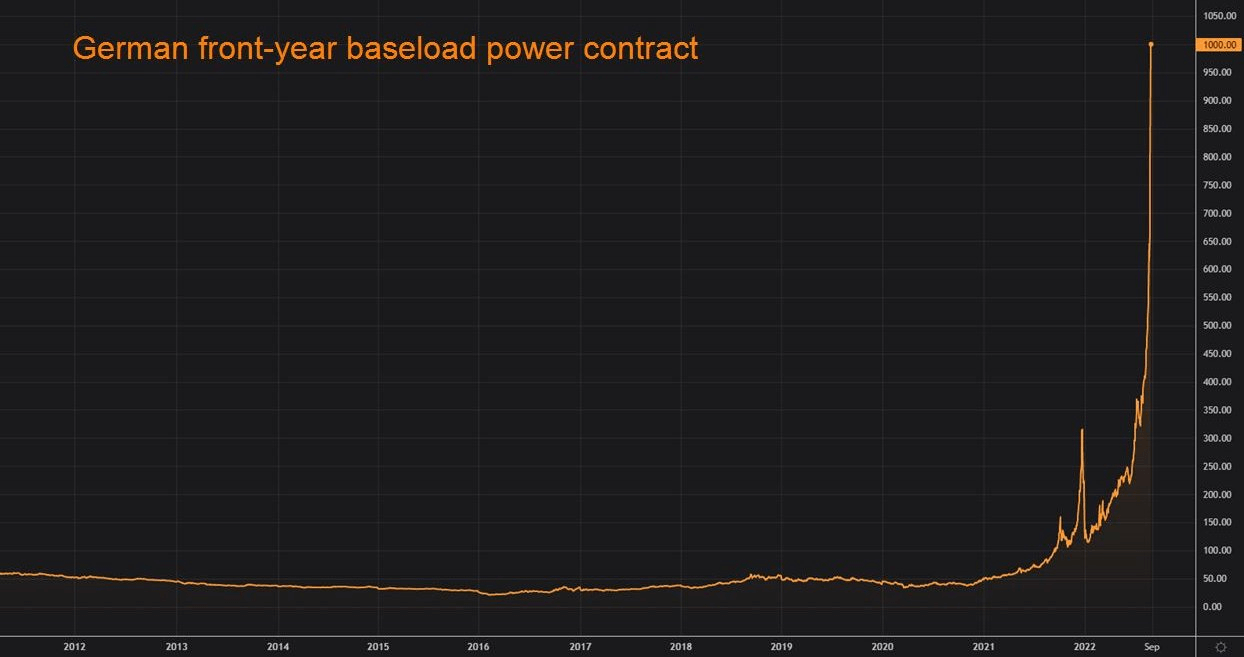

Germany and France have seen year-over-year prices per MWh rise 10-fold from last year, while other countries are gearing up for price increases that could exceed 1,000% by the end of winter.

Economists warn that energy shortages could cause factories to close and small businesses unable to afford their electricity bills to go bankrupt.

Many believe that ending the war in Ukraine will end Europe’s energy crisis, but there are several other factors that could extend the crisis beyond the war.

As Europe depends on Russian natural gas, nuclear power generation in the region has been halted. This decline in nuclear energy use has hit France hardest, as 31 of its 57 reactors are shut down for emergency maintenance. Since the beginning of the year, France has imported energy for her 102nd record high. In contrast, the country imported no energy between 2014 and 2016.

With the EU’s push for green energy, many countries are shutting down coal-fired power plants and switching to renewable energy sources such as natural gas and solar and wind. This was most felt in Germany, where efforts by local governments to reduce reliance on polluting energy sources could backfire. Few other countries are as dependent on Russian gas as Germany, and the country now has to deal with the blow from higher energy prices and its economic impact.

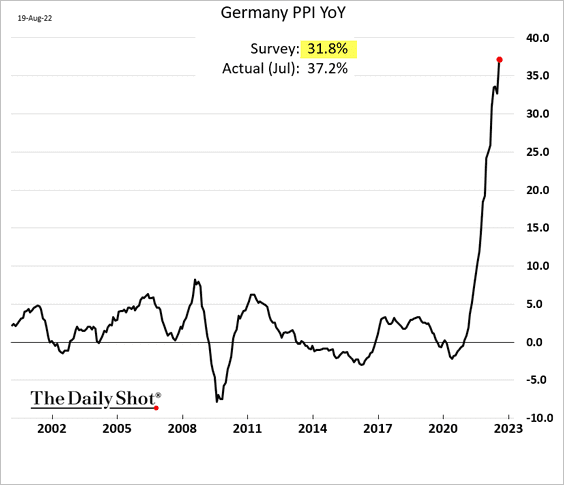

Germany’s Producer Price Index (PPI) rose 33% in July and is expected to rise as winter approaches. Every rise in PPI affects producers and consumers. Rising production costs make local manufacturers less competitive and destroy margins. In contrast, consumers bear the increased cost of the final product. Continued increases in PPI and CPI have led German trade unions to demand an 8% wage increase statewide. Many economists warned that the move could further exacerbate inflation.

Meanwhile, the ECB’s attempts to fight inflation in its southern members have done more damage to the euro.

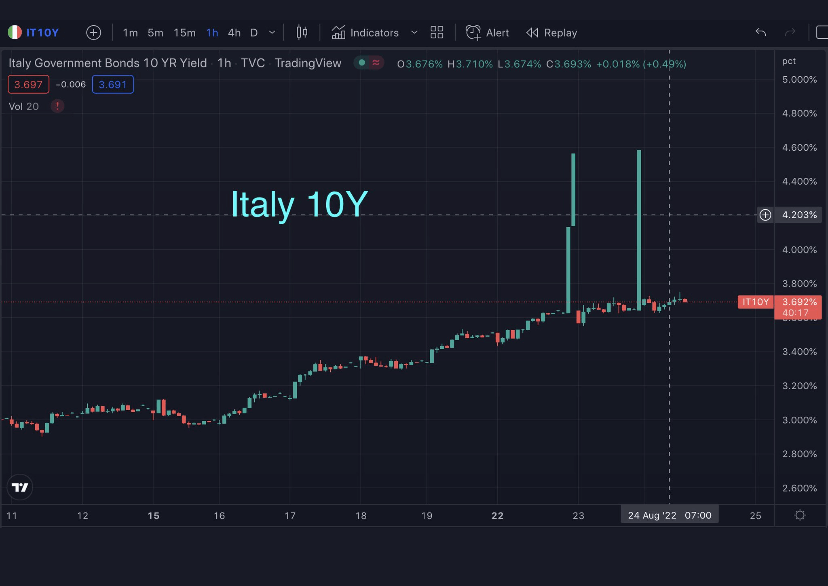

In July the ECB clearly New plans to reduce borrowing costs by buying government bonds if yields on government bonds in Italy, Spain, Portugal and Greece rise too high.Data released earlier this month showed that the ECB deployed €17.3 billion to buy government bonds from the southern member states of the EU. The debt was purchased using funds from mature debt of existing bond holdings. According to official figures, the ECB’s net holdings in German, French and Dutch bonds fell by €18.9bn over the past two months.

To encourage aggressive bond purchases, the ECB has divided the EU into three categories. Donor countries consist of Germany, France, and the Netherlands, and recipient countries are Italy, Spain, Portugal, Greece, and neutral countries.

Banks said financial fragmentation between these categories had forced them to activate these purchases.BTP-Bund spread fell to 250 basis points for first time in two years when ECB announced plans has reached a high.

The BTP-Bund spread is the difference between the yields of 10-year Italian government bonds (BTP) and 10-year German bonds (band). Bond purchases reduced the gap to 183 basis points, but it returned to 229 points in a month as political unrest in Italy called into question the stability of the country’s economy.

The importance of the BTP-Bund spread lies in Germany’s position. German debt has historically been seen as the risk-free benchmark against which all EU debt is compared. However, the steep inflation and imminent energy shortages expected in the winter could undermine Germany’s ranking as a risk-free benchmark for European sovereign debt and bring further volatility to secondary bond markets.

Many banks and financial institutions question both the effectiveness and legality of the ECB’s intervention in Italy. Aggressive bond purchases thwarted any attempt to stabilize domestic inflation.

Higher bond yields, on the other hand, could lead to defaults by EU member states and hyperinflation. All member states of the EU share the same currency, so if the euro hyperinflates in one member state, other member states may experience similar volatility.

This makes the ECB the last buyer for much of the European bond market as central banks fight to prevent member defaults. The ECB will have to print more money to fund these bond purchases if the debt of its existing bond holdings does not mature in time. But increasing the printing rate of the new euro will do little to curb rising inflation in Europe.

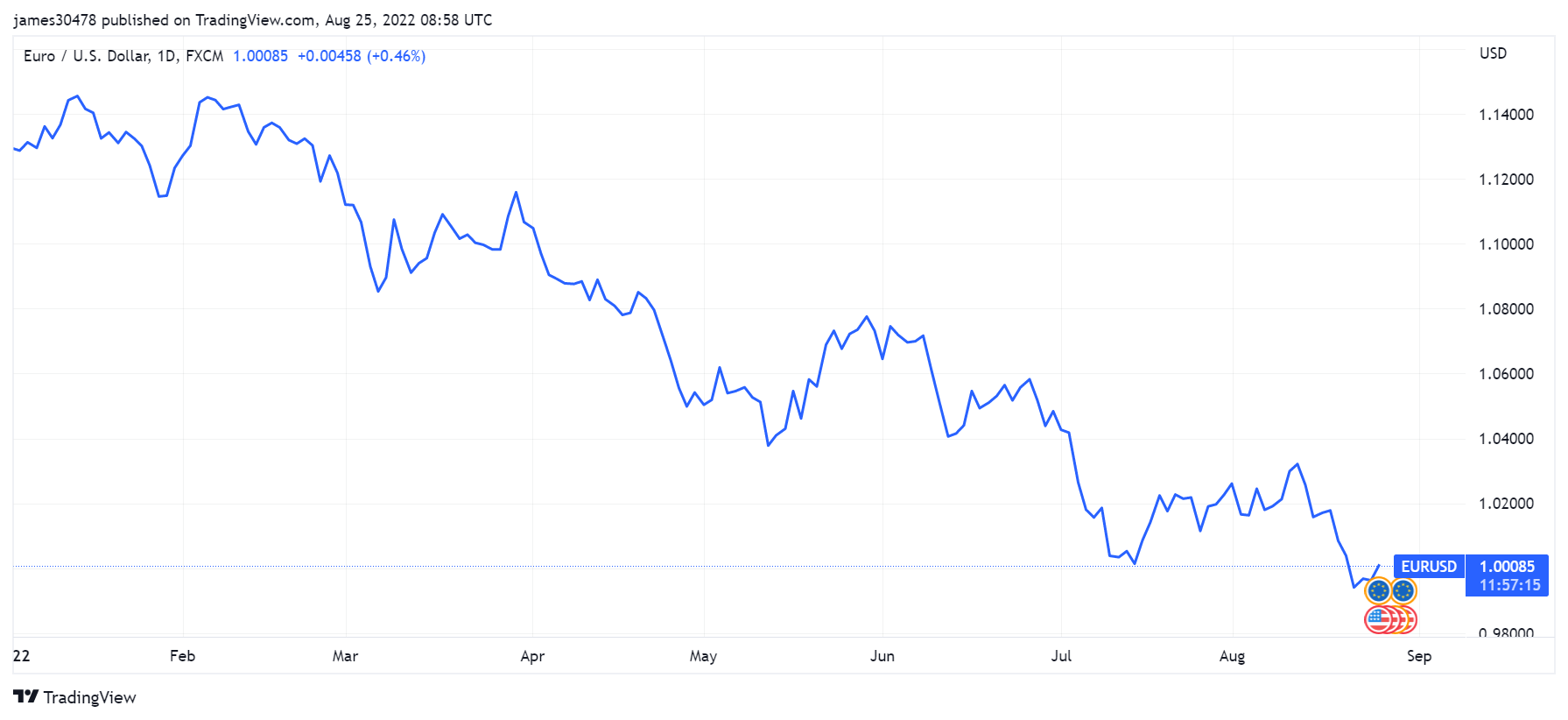

The euro, the world’s second-largest currency by market capitalization, has lost 16% of its value against the US dollar since the beginning of the year. It also underperformed against the US dollar for the second time this year.

If the Federal Reserve continues to raise interest rates and the ECB continues to buy European government bonds, this downtrend could continue in the coming months, exacerbating higher energy and food prices.

Historically, people have flocked to hard, scarce assets in times of recession, choosing tangible investments like commodities, land, and real estate. If a recession hits Europe outright, money could flow into the cryptocurrency market, especially Bitcoin. Bitcoin’s reputation as a safe-haven asset can make it attractive as both a long-term investment and a store of value. Recent efforts by the governments of Russia and Iran have been to introduce cryptocurrencies as a means of payment, and other countries may follow suit. Increased adoption could eventually lead to large regional gas and energy producers demanding cryptocurrency payments if the euro remains on its current trajectory.