TokenInsights data reveals crypto winter may be thawing

Research firm TokenInsight has released its first quarter crypto exchange report. This marks a strong start to his 2023 for centralized platforms.

of report said the cryptocurrency market cap increased from $831.8 billion to $1.24 trillion during the quarter. This is his nearly 50% increase. Bitcoin (BTC) surged almost 100% from $16,000 to $30,000 during the period.

With this, TokenInsight suggests that the crypto winter may be over and encourages readers to use exchange indicators to make decisions.

“It looks like winter is over for the crypto industry as the price of Bitcoin rises from $16,000 at the beginning of the year to a high of $30,000. The sensible answer will come from exchange data.”

crypto trading volume

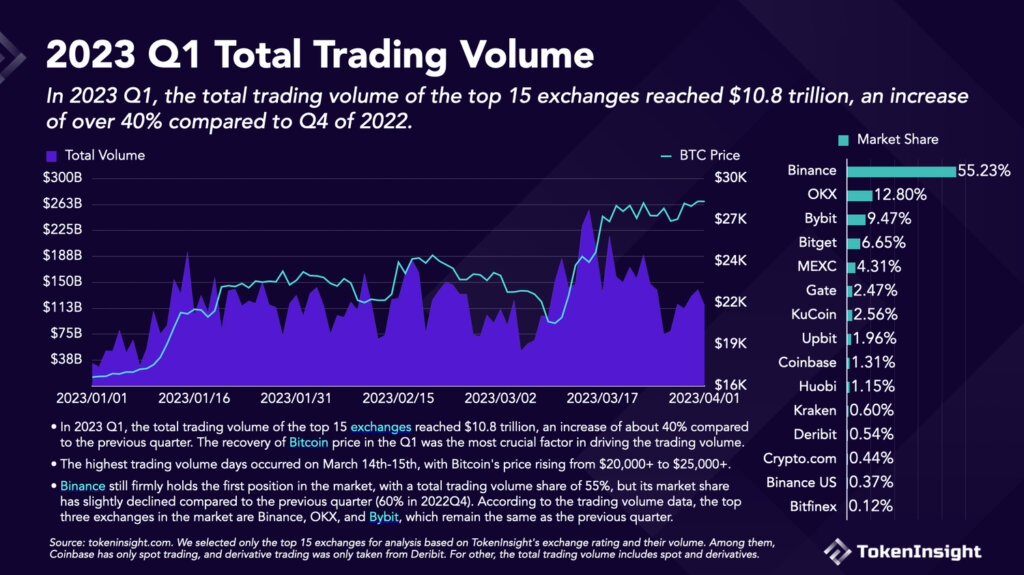

Total trading volume for the top 15 cryptocurrency exchanges in Q1 2023 increased 40% compared to the previous quarter to $10.8 billion.

The period around March 14-15 saw the biggest increase in daily trading volume as the Bitcoin price recovered from the effects of the banking crisis. This is likely driven by perceptions of the fragility of fiat currencies and demand for harder assets.

Binance maintained its dominance throughout the quarter, with more than half of its 55% market share. However, TokenInsight noted that Binance held his 60% market share in Q4 2022. This suggests recent regulatory enforcement actions and bankruptcy rumors are having an effect.

Other exchange indicators

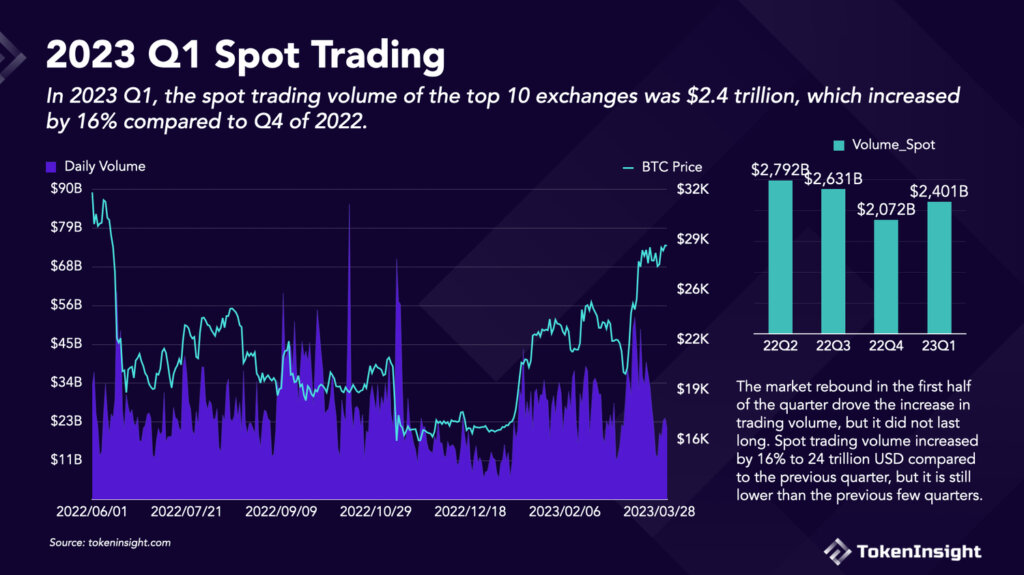

Spot volume on the top 10 cryptocurrency exchanges increased 16% from the previous quarter to $2.4 trillion. However, this is still down compared to Q3 and Q2 2022 ($2.6 trillion and $2.8 trillion respectively).

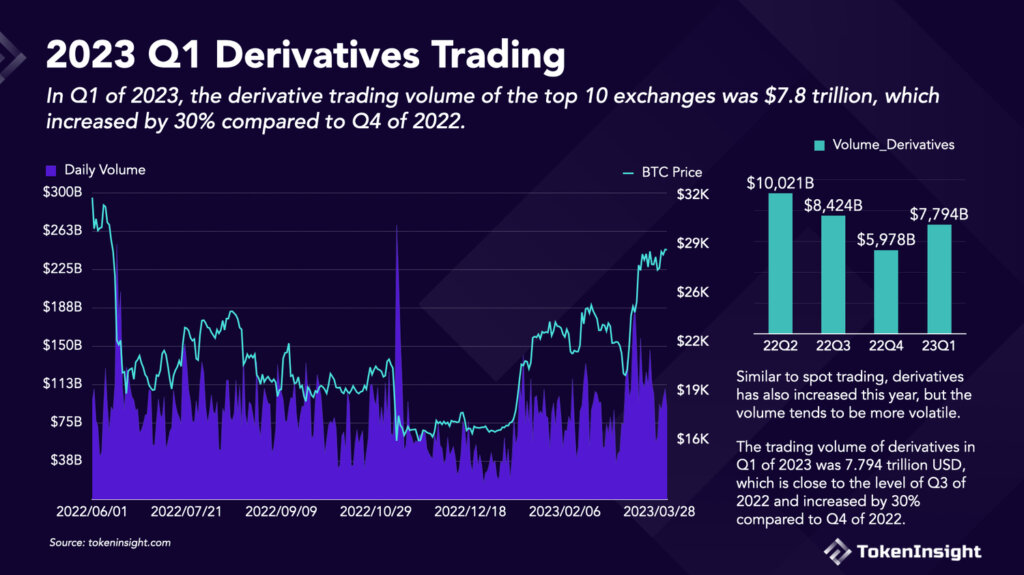

The same pattern was repeated in derivatives volume, which increased 30% from the previous quarter to $7.8 trillion in Q1 2023. However, compared to his $8.4 trillion in Q3 2022 and his $10 trillion in Q2 2022, he is still down.

exchange token

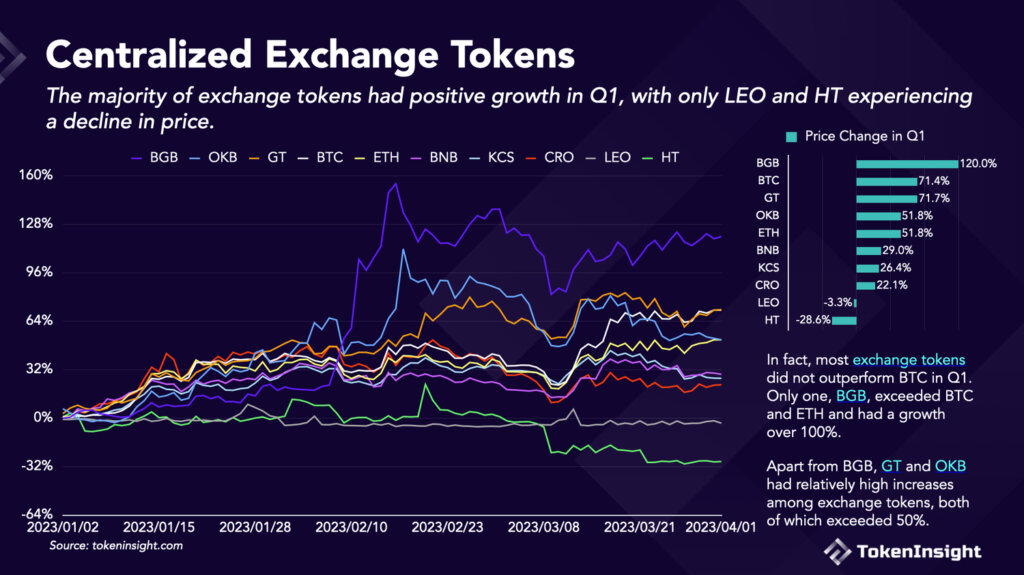

Given the spate of centralized finance (CeFi) bankruptcies in 2022, exchange tokens had a bad reputation.

A good example of this is FTX’s FTT token, which was used to prop up the exchange’s balance sheet, allowing the company to borrow against the token. This worked well until a panic sell sent his FTT value plummeting. In other words, FTT’s secured loans have lost their backing and are worthless.

Nevertheless, the chart below shows the confidence return of the exchange token. TokenInsight found all but UNUS SED LEO and Huobi Token increased in price. Bitget Token grew 120% over the period, surpassing Bitcoin.

GateToken came in second, roughly matching Bitcoin’s growth, with a 72% increase in value during the quarter. Other exchange tokens underperformed against market leaders.