Traders turn to stablecoins as regulatory pressure in the US ramps up

A wave of regulatory pressure sweeping through the U.S. cryptocurrency market has turned traders away from Bitcoin (BTC) and Ethereum (ETH) to safer-looking stablecoins.

This shift coincides with a burgeoning political movement in the United States aimed at imposing tighter regulations on the cryptocurrency and mining sectors. Proponents of the new regulation argue that the disruptive nature of cryptocurrencies calls for stricter regulation to ensure the stability and security of the financial ecosystem.

Critics, meanwhile, have expressed concern that heavy-handed regulation could stifle innovation and drive the industry overseas. This polarizing debate is creating an atmosphere of uncertainty that is reshaping trading behavior.

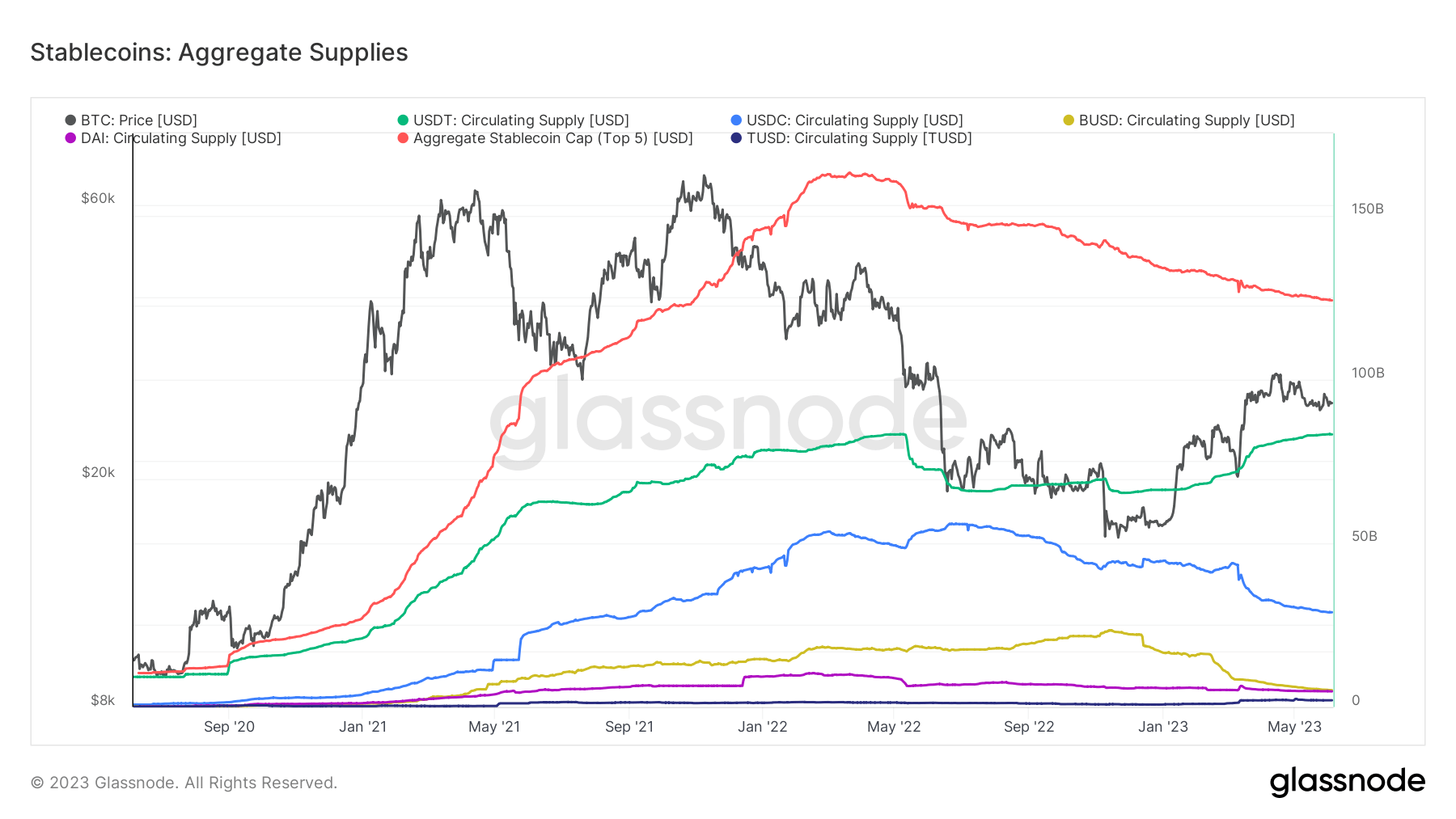

These regulatory pressures appear to be pushing traders toward stability in stablecoins. This is clearly observed in the behavior of USDT on Tether, which reached an all-time high of $83.2 billion in supply on June 3rd. About $17 billion of this will add to Tether’s market cap in 2023 alone.

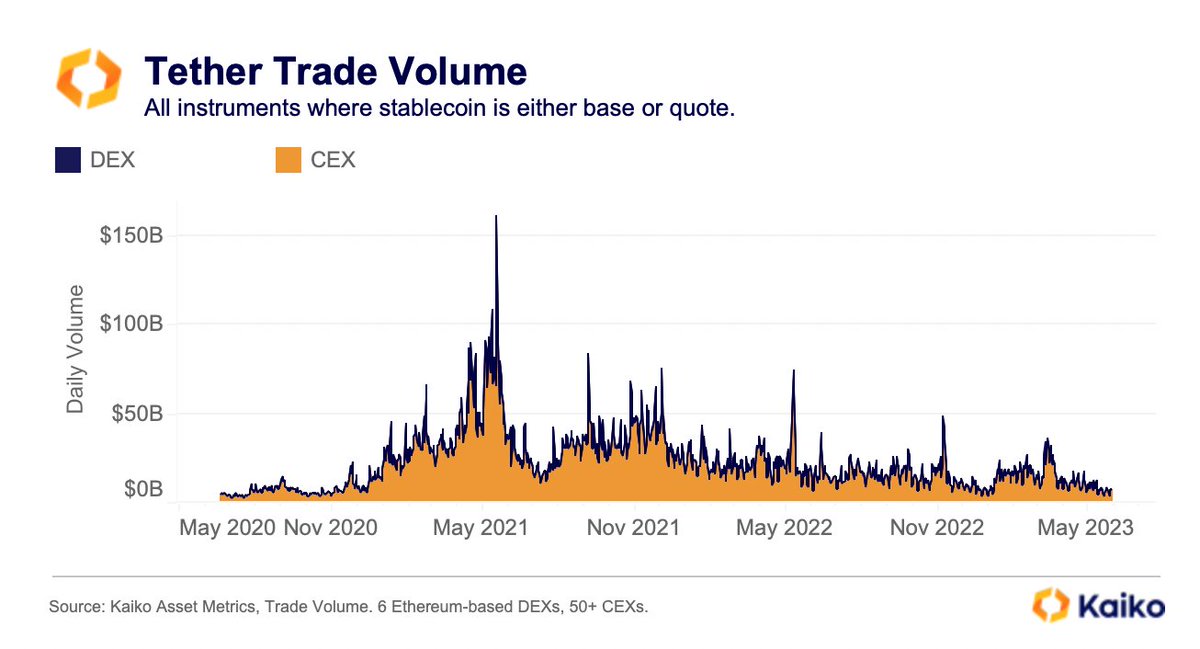

However, even though Tether’s market capitalization is increasing, trading volume is trending downward. According to Kaiko’s data, both CEX and DEX, his daily USDT trading volume averaged around $7 billion in May, hitting a multi-year low. This seeming contradiction suggests that while the overall supply is increasing, the asset’s active trading is decreasing.

Conversely, other key players in the stablecoin market, USDC and BUSD, witnessed supply dwindle to multi-year lows.

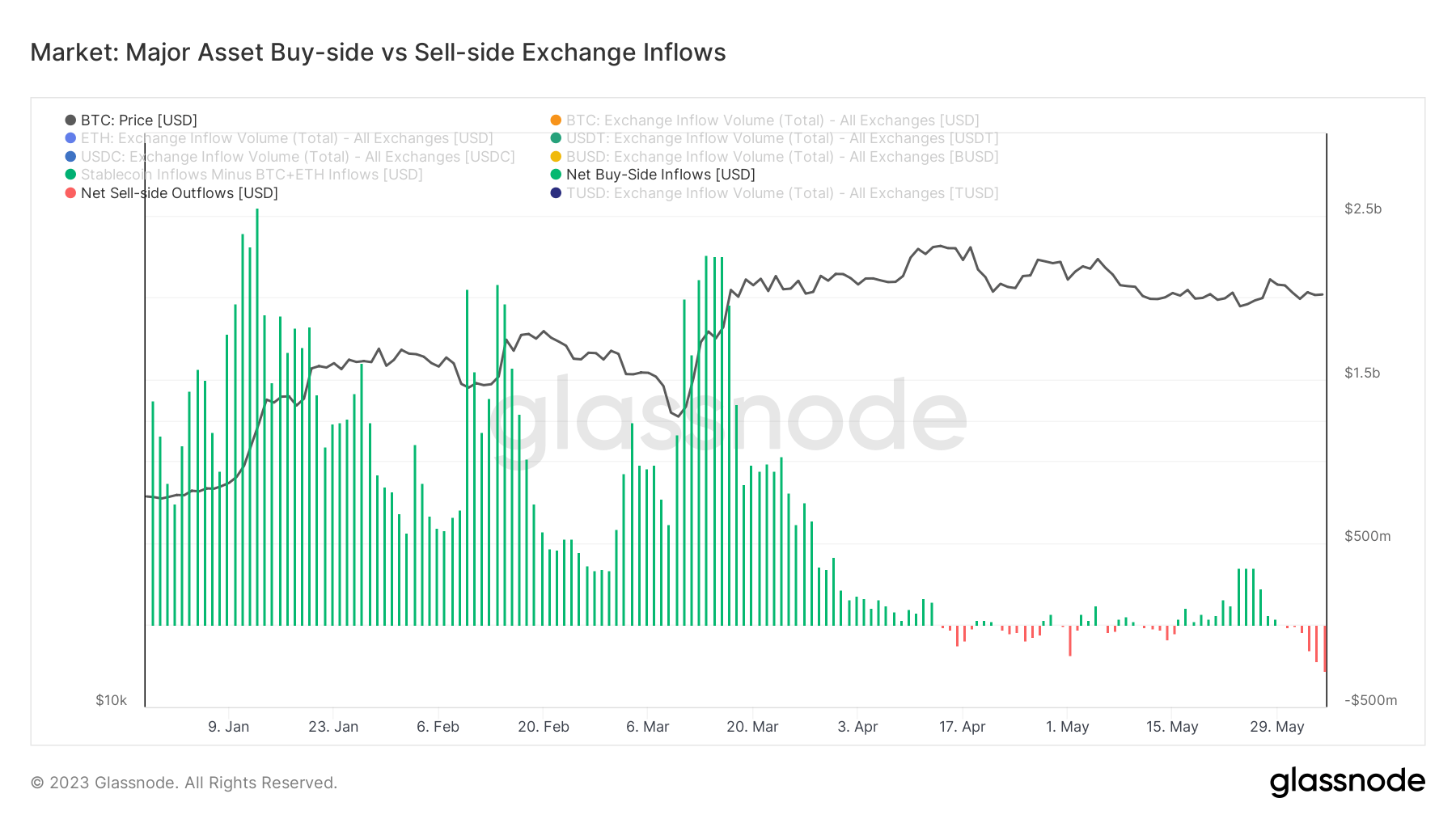

Analysis of currency inflows reveals an interesting trend. Demand for stablecoins on exchanges has weakened since April, which is being compensated by the influx of BTC and ETH. Despite sustained inflows, the two cryptocurrencies have experienced mostly sideways trading, or unfavorable price movements, indicating that most of the inflows are likely sell-side.

Stablecoins are interest-free and exempt from capital gains tax, which makes them attractive to traders. Due to their nature, there are no taxable events that are essential for trading BTC or ETH. This is particularly attractive to US traders who are starting to feel the pressure of increased regulatory scrutiny and potential enforcement action.

The post Traders Focus on Stablecoins amid mounting US regulatory pressure first appeared on CryptoSlate.