U.S. agency moves over 9k BTC to Coinbase: Glassnode

According to on-chain data, US law enforcement moved 49,000 Bitcoins (BTC), worth more than $1 billion, in the early hours of March 8.

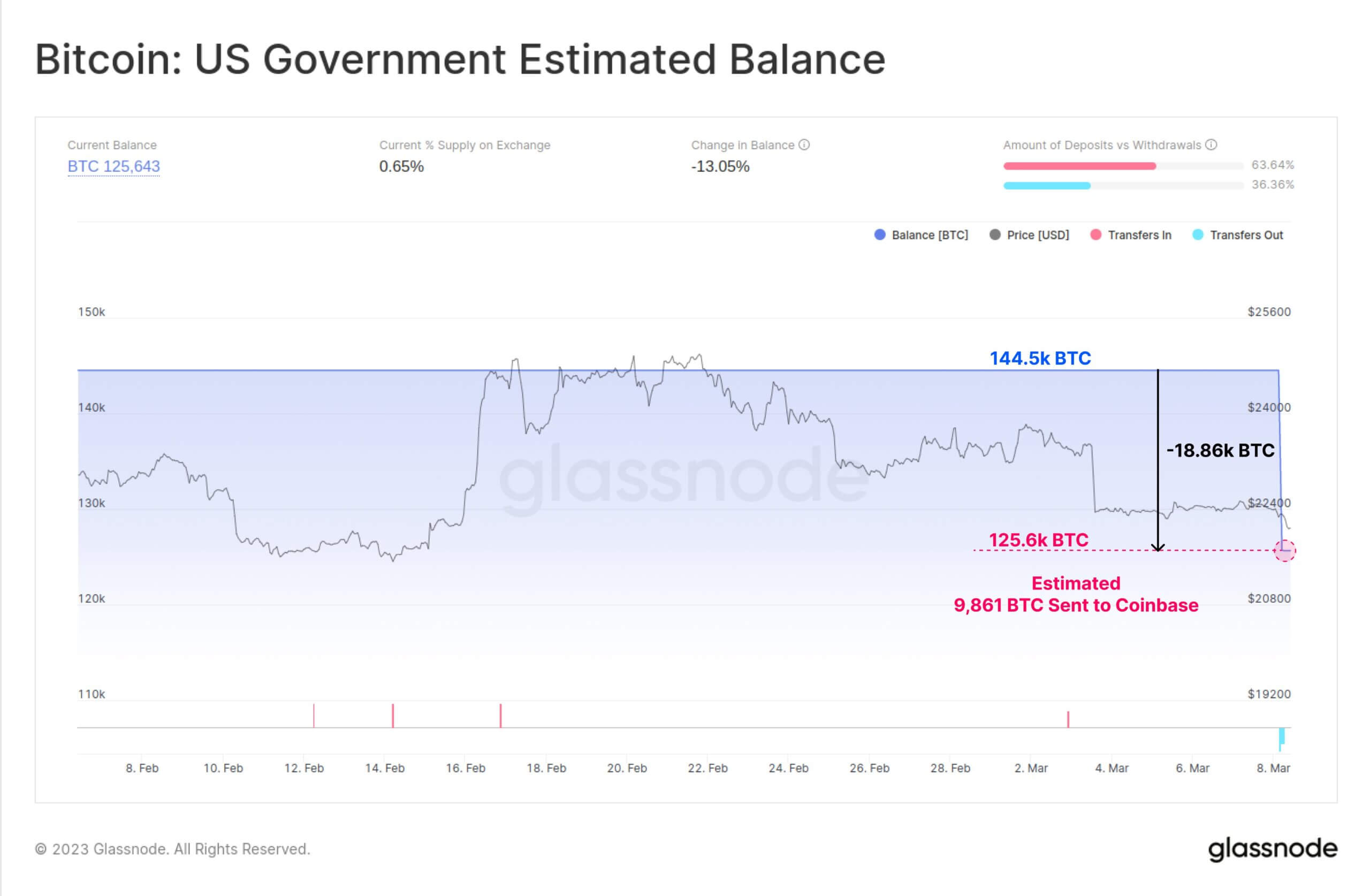

On-chain data provider Glassnode report The US agency has moved about 40,000 BTC, adding that the transaction appears to be an internal transfer. Sent 9,861 BTC worth $219 million was seized by Coinbase from Silk Road hackers.

By 2022, the U.S. government will sought Confiscation of 51,351 bitcoins seized from James Zhong. At the time, the assets were valued at over $3 billion.

On-Chain Analyst Lookonchain backed up Glassnode report adding agency forwarded 39,175 Bitcoin ($867 million) to two new addresses.

US government holdings of BTC

Ahead of today’s trade, Glassnode said the US government has an estimated Bitcoin holdings of 144,500 BTC, making the country a crypto whale.

On the other hand, the majority of US acquisitions were made by seizure. In 2022, the U.S. Department of Justice seized $3.6 billion worth of Bitcoin in connection with his 2016 Bitfinex hack. Before that, the government robbed Ross Ulbricht of his 70,000 BTC when it brought down the Silk Road.

However, countries tend to auction seized crypto assets. As of February 2022, the U.S. government will hold $4.08 billion bitcoin.

Bitcoin drops 2% in 24 hours

Bitcoin has fallen 1.67% over the past 24 hours and is trading at $22,048 at the time of writing. of crypto slate data.

US distributor transfer was born Speculation within the community, many fear the sale. Usually, when BTC flows into an exchange, there is more selling pressure on the asset.

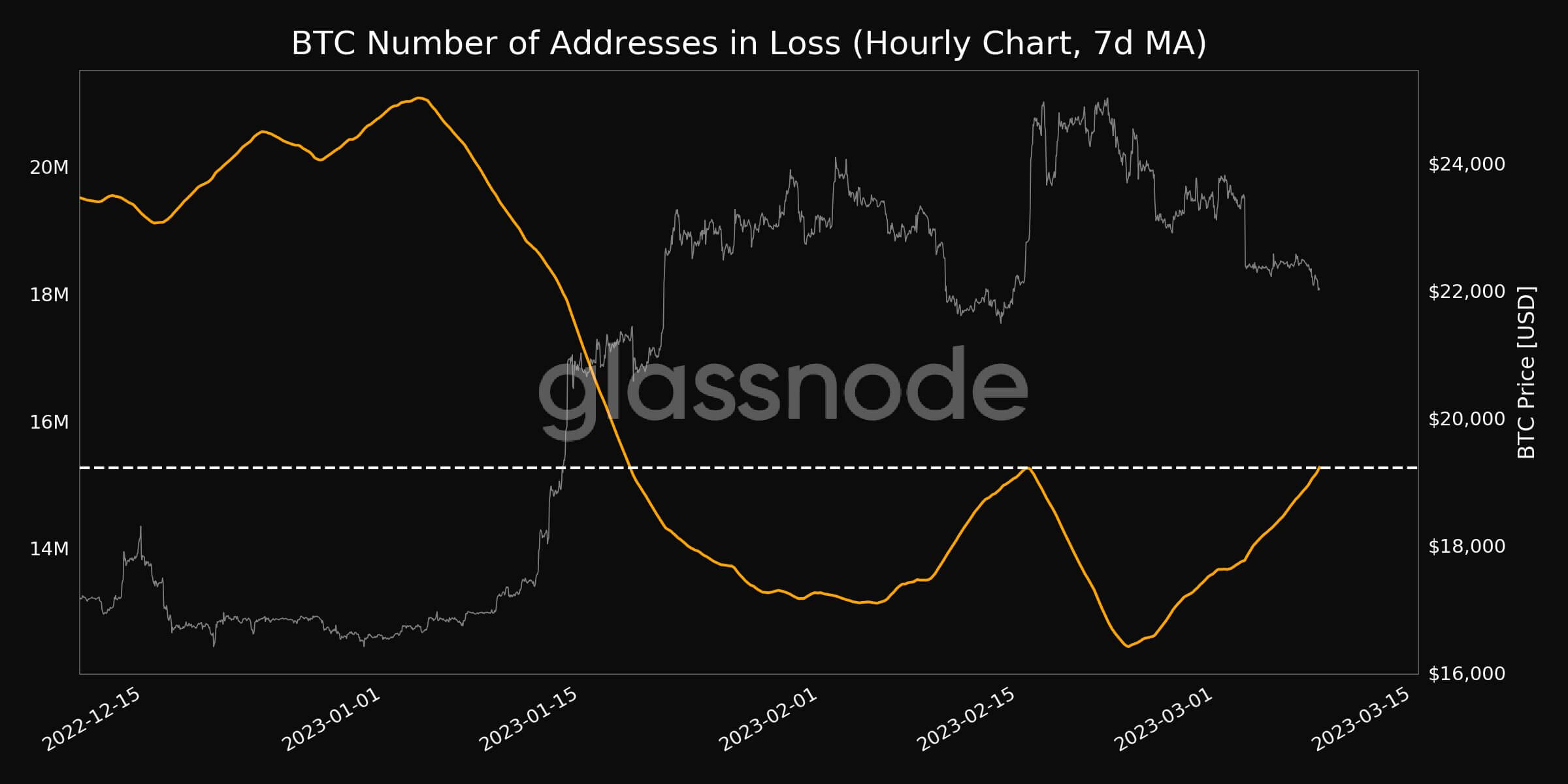

with bitcoin Abandoning much of January and February’s riseGlassnode data The 7-day moving average metric showed that the number of addresses holding BTC in losses reached a one-month high of 15,270,797.429.

crypto slate Insight reported that around $200 million in Bitcoin was withdrawn from exchanges on March 7.

Meanwhile, Fed Chairman Jerome Powell’s recent statements about rising interest rates further undermined price performance.