USDC adoption on Ethereum grows post-FTX collapse; USDT remains flat

After a series of brutal events led to the collapse of several crypto-related companies in 2022, FTX’s bankruptcy has dealt a huge blow to public trust in the centralized crypto entity.

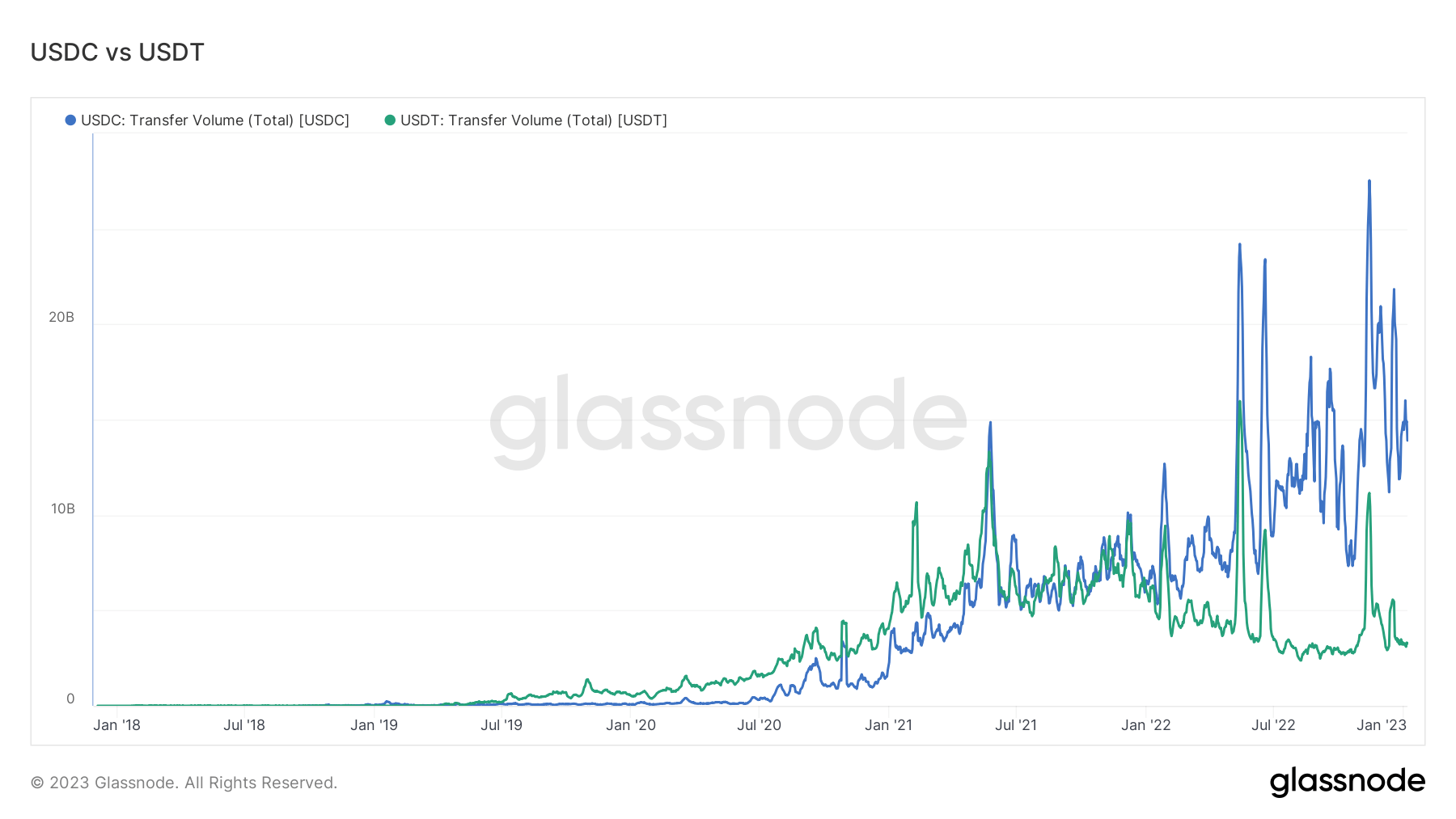

During this period of heightened market volatility, crypto investors preferred Circle’s USD Coin (USDC) over Tether’s USDT. USDT is the largest stablecoin by market cap, according to Glassnode data, while USDC has more transfer volume.

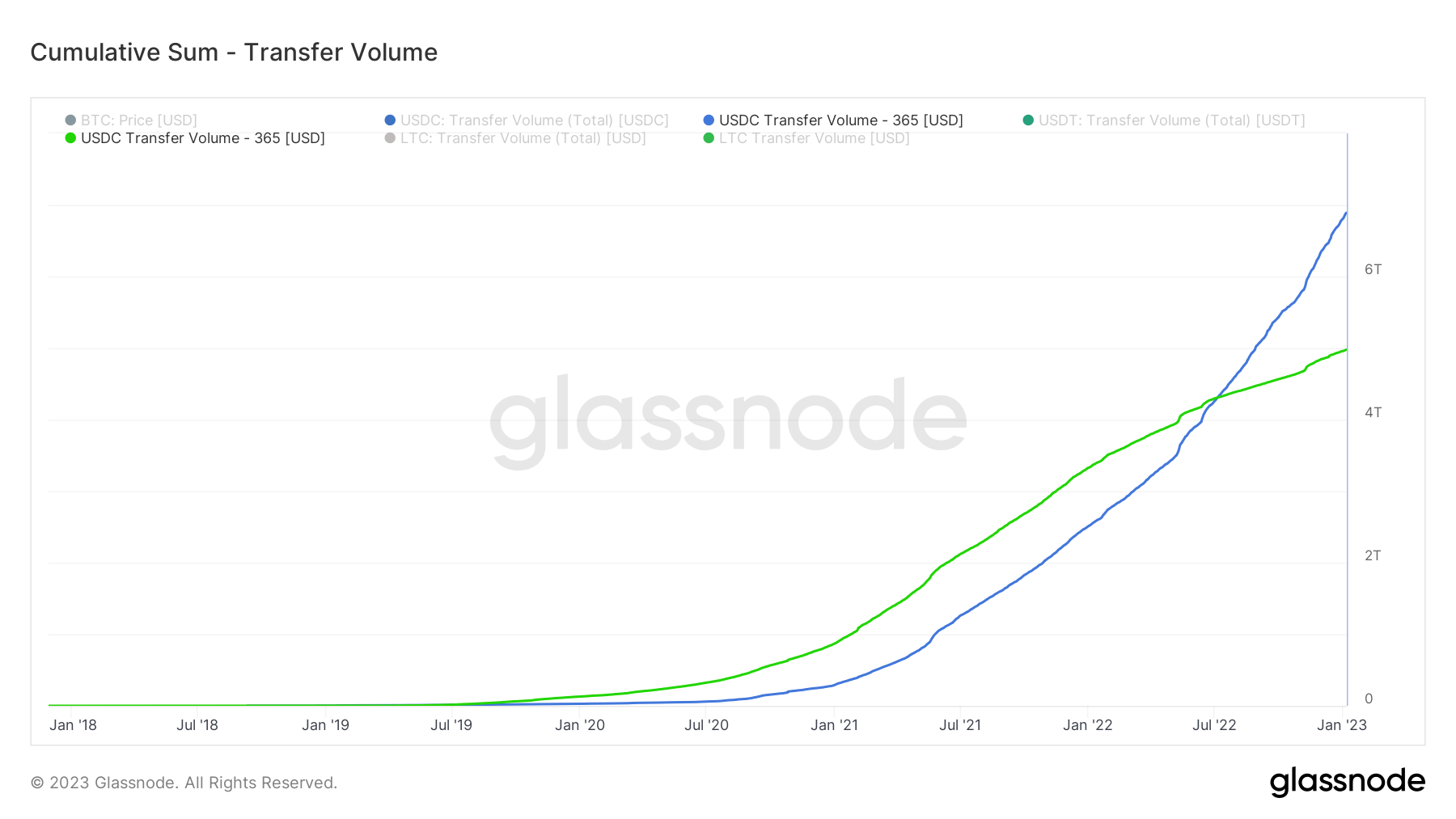

According to data, USDC remittance volume is $15 billion, while USDT remittance volume is $3 billion. Cumulatively, USDC outperforms USDT by $7 trillion.

On the other hand, the Glassnode chart below shows that the transfer volume disparity is not always like this: USDT volume surpassed USDC volume in 2020 and early 2021.

At that time, USDT began facing regulatory scrutiny over its reserves, coupled with the collapse of Terra’s LUNA.

USDC Exchange Balance Reaches $5 Billion

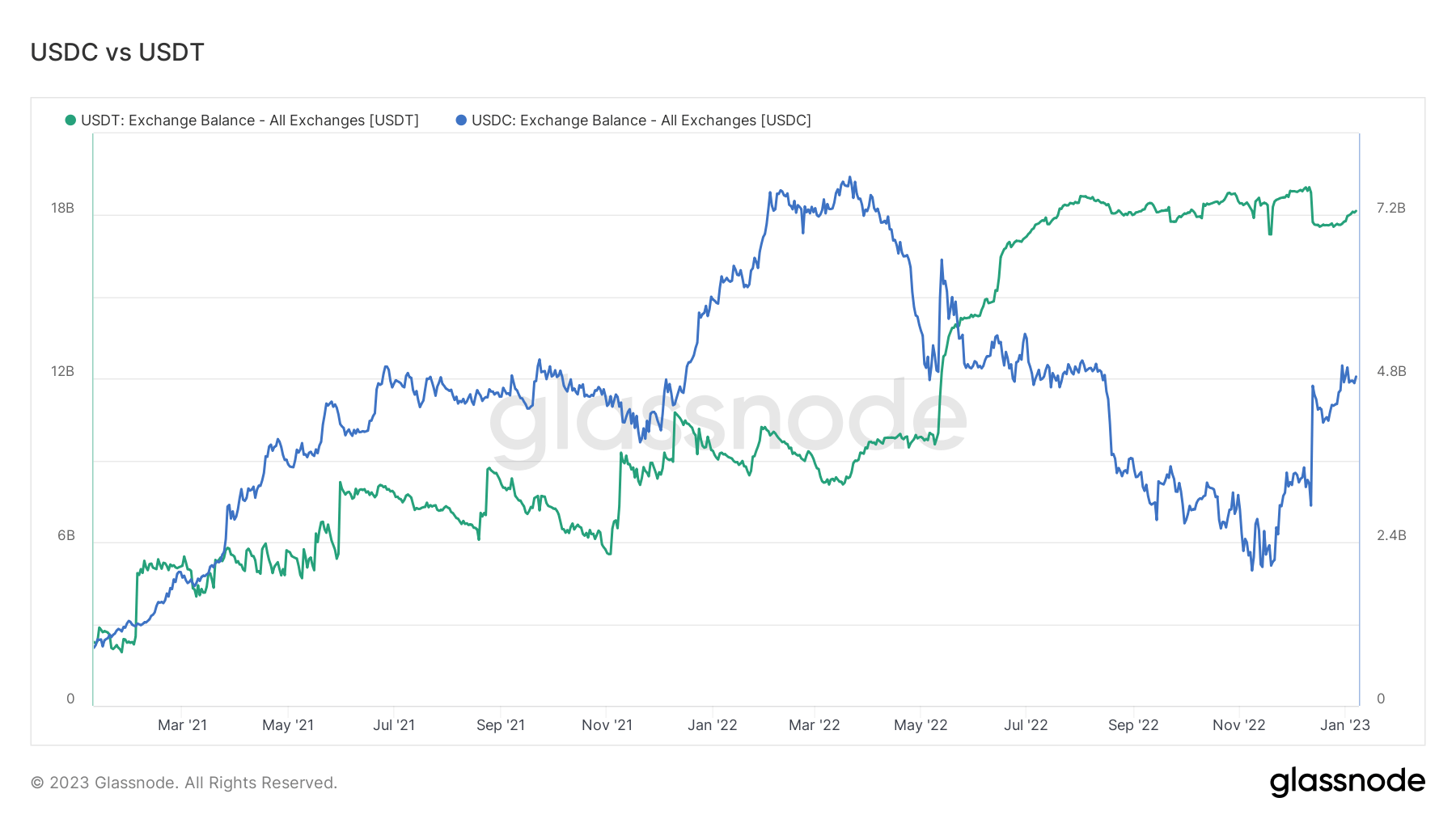

As for exchange balances, Glassnode data shows that USDC is starting to enjoy more adoption after the FTX demise. His USDC on the exchange is nearing his $5 billion, according to data.

Previously, adoption of USDC in 2022 was on the decline as Binance made the decision to convert users’ USDC and other stablecoin balances to BUSD. However, USDC adoption began to trend upward towards the end of the year as the FTX collapse spawned his FUD and led to record withdrawals from Binance.

Besides that, Coinbase encouraged users to convert USDT to USDC for free.

USDT exchange balances, on the other hand, saw even a slight decline in early January 2023.

USDT raised more questions about its reserves at some hedge funds after FTX crash short circuit stablecoin. However, its publisher said Tether will continue to show resilience in the face of uncertainty.

2023 is set to be a risk-off year, and the stablecoin market is likely to grow further. This could set the stage for a dominance battle between USDT and USDC.