Vitalik deems crypto better than gold; SBF hints at creating FTX-backed stablecoin

The biggest news in the Cryptoverse on October 27th included Vitalik Buterin asserting that crypto is better than gold, FTX planning to create a stablecoin, Bitcoin mining company Core Scientific on the brink of bankruptcy Some users pay as little as $0.08 in fees to settle over $500 million in transactions on the Bitcoin network.

CryptoSlate Top Stories

Buterin says crypto is a better bet than gold

Zach Weinersmith started the argument claiming that gold is better than Bitcoin. Because gold meets crypto’s claim to decentralized money.

In response, Ethereum co-founder Vitalik Buterin argued that cryptocurrencies would be better, given that gold is inconvenient to use for transactions and lacks a secure storage mechanism for multiple users. He said it was a good deal.

World’s Largest Bitcoin Mining Company Core Scientific Near Bankruptcy

Bitcoin mining company Core Scientific said it may soon file for bankruptcy as rising electricity costs and falling bitcoin prices have made its business unprofitable.

With just 24 BTC and around $26.6 million in cash, the mining firm says it may not be able to sustain operations beyond the end of 2022 unless it successfully raises additional funding.

SBF Suggests FTX Might Create Its Own Stablecoin

FTX CEO Sam Bankman-Fried went live with Big Whale and hinted at plans to launch a stablecoin for his crypto exchange.

According to SBF, FTX is putting the creation on hold as it is working with a stablecoin issuer. However, we may see an FTX-backed stablecoin launch in the not too distant future.

Team Finance lost $14.5 million to smart contract bug exploit

token protection protocol team finance $14.7 million in attack after hackers exploited V2 to V3 migration feature vulnerability.

As a result, the protocol has suspended all trading activity until the bug is fixed. However, it assured users that any remaining funds would be safe and available once operations resumed.

$0.80 fee for Bitcoin transactions worth $500 million

Approximately 24,530 BTC, worth more than $500 million, were sent over the Bitcoin network and charged just $0.83 in fees to execute the transaction within minutes.

In contrast, traditional payment networks like SWIFT charge about $15 million with a 3% exchange rate fee to execute $500 million transactions.

Ethereum Becomes 50th Largest Asset By Market Cap After Recent Price Moves

Ethereum’s recent move to $1,560 has pushed the second-largest crypto asset higher, making it the 50th most valuable asset in the world.

Ethereum, with a market cap of $190 billion, overtook Cisco and Alibaba, and moved ahead of Toyota and Walt Disney, with a market cap of $195 billion.

Messina’s CEO Willing To Bet His Porsche On BTC To Reach $6 Million Again

Bitcoin maximalist Jim Messina says he is buying more bitcoin even though the price is dropping. He added that he could bet on his Porsche that Bitcoin would set him back $60,000.

research highlights

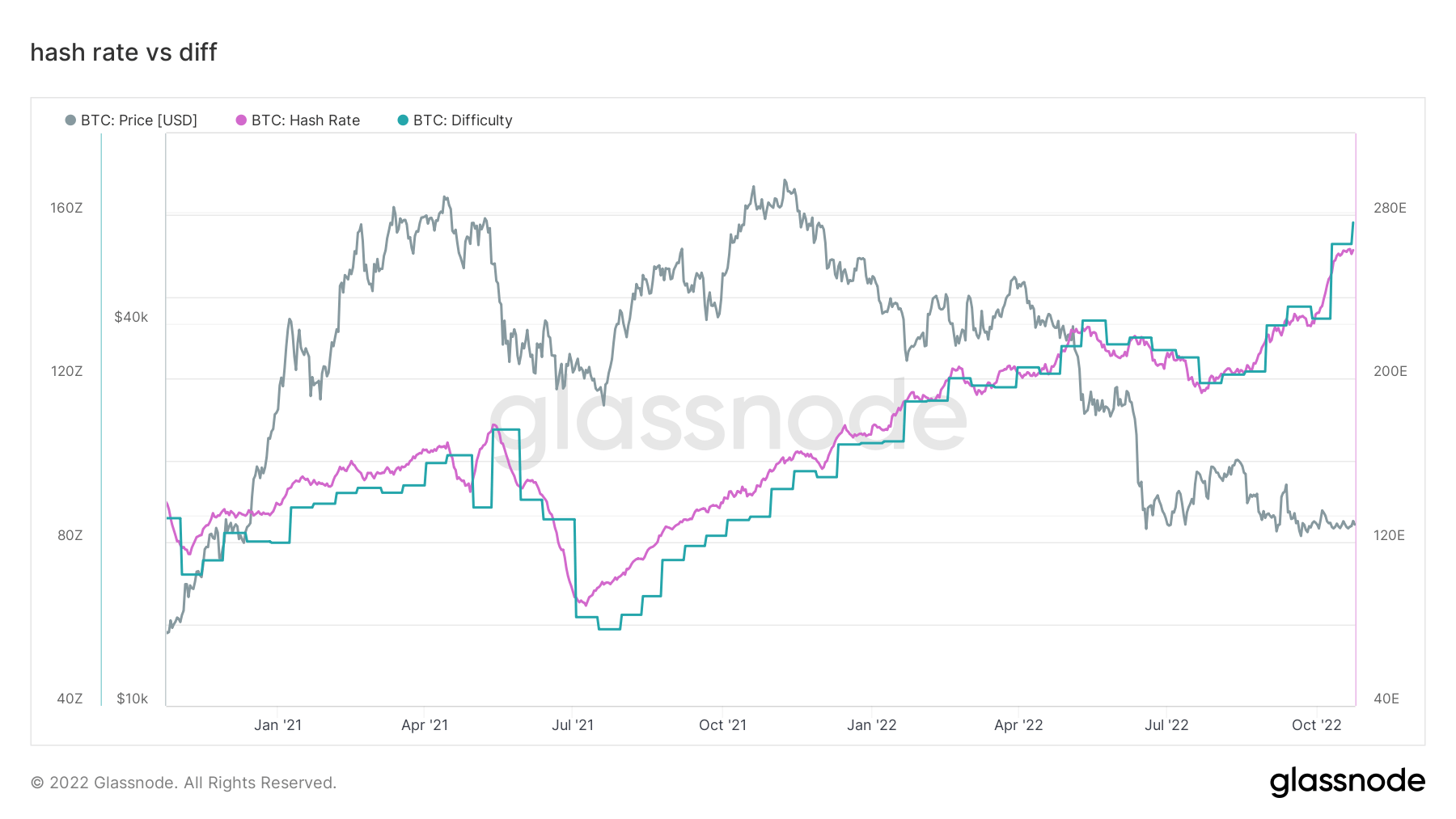

A Deep Dive into Bitcoin’s Hashrate, Why It’s Rising, and Whether It’s Going to Rise Again

Bitcoin mining difficulty and hash rate have hit all-time highs since the beginning of the year, despite the falling Bitcoin price, according to CryptoSlate analysis.

As early as January 21st, Bitcoin mining difficulty reached 26.64 trillion. By February 18, it surged to 27.97 trillion. However, on October 24th, the mining difficulty hit his 36.84 trillion and hashrate hit 260 EH/s, the highest spike ever.

A possible explanation for the sustained surge could be related to the Ethereum merger. After the merger, ETH miners flocked to the Bitcoin ecosystem, making it increasingly difficult to process transactions on the network.

News around Cryptoverse

Luxrare Offers Zero-Royalty Transactions

rare to see Said Instruct NFT creators to pay 25% of the protocol fee as royalties. For transaction rewards, 95% goes to the seller and the buyer gets his 5% cashback.

Huobi to delist HUSD stablecoin

Crypto exchange Huobi announced We plan to delist the native HUSD stablecoin. All of his HUSD pending on crypto exchanges will be converted to USDT before being delisted on October 28th.

crypto market

Over the past 24 hours, Bitcoin (BTC) has fallen -0.51% to trade at $20,648, while Ethereum (ETH) has also risen +0.03% to trade at $1,563.