What are crypto liquidations and why do they matter?

In the last few months Liquidation Became the top of the news cycle in the crypto world. This article describes what clearing is in the context of cryptography, how they occur, and what you can do to avoid them.

What is cryptocurrency clearing?

Liquidation is the forced closure of all or part of an initial margin position by a trader or asset lender. Clearing occurs when a trader is unable to meet its leveraged position quota and does not have sufficient funds to continue trading.

Leveraged position refers to using an existing asset as collateral for a loan or borrowing, and then using the already pledged principal and borrowing to buy a financial instrument together to make a greater profit. ..

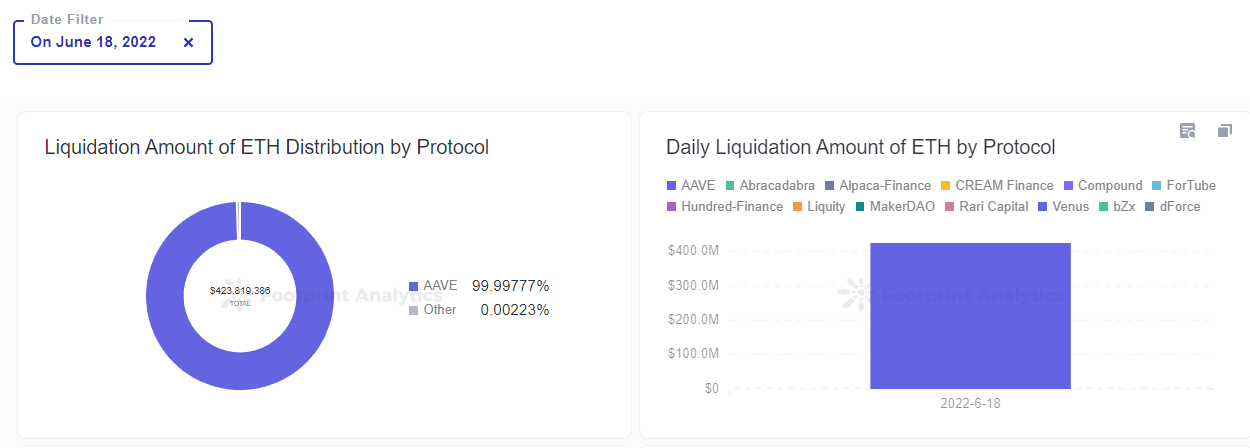

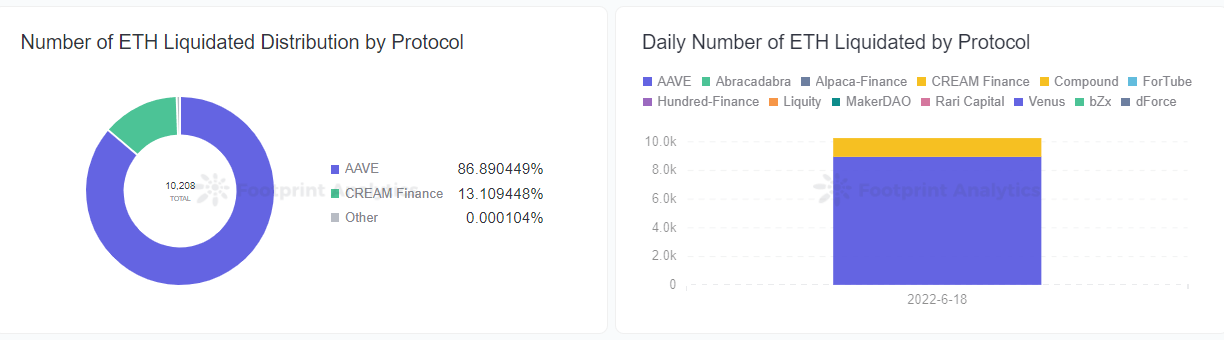

Most lending protocols, such as Aave, MakerDAO, and Abracadabra, have a clearing function. According to Footprint Analytics dataOn June 18, when the price of ETH fell, 13 clearing events occurred in the DeFi market. On the same day, the loan protocol liquidated 10,208 ETH, with a liquidation amount of $ 424 million.

There is a liquidator in the liquidation. Large institutions and investors can buy liquidated assets at a discounted price and sell them on the market to make a difference.

Why does cryptocurrency clearing occur?

In DeFi, stake lending means that the user puts the asset into the lending protocol in exchange for the target asset and then invests again to increase income. It is essentially a derivative. To maintain the long-term stability of the system, the lending protocol designs a clearing mechanism to mitigate the risk of the protocol.

Let’s see MakerDAO..

MakerDAO supports various currencies such as ETH, USDC and TUSD as collateral to diversify the risk of protocol assets and regulate the supply and demand of DAI. MakerDAO has set a 150% stake, which is over-collateralized. This determines the trigger for clearing.

Here is an example:

If the price of ETH is $ 1,500, the borrower can bet 100 ETH on the MakerDAO protocol (equivalent to 150,000) and lend up to $ 99,999 DAI at the 150% bet rate set by the platform. At this point, the clearing price is $ 1,500.

When the price of ETH falls below $ 1,500, ETH reaches stake rates and is vulnerable to platform clearing. When liquidated, it is equivalent to a borrower buying 100 ETH for $ 99,999.

However, if the borrower does not want to be cleared immediately, there are several ways to reduce the risk of clearing.

- Lend DAI for less than $ 99,999

- Return the loaned DAI and fees before the clearing trigger

- Continue betting more ETH and lower betting rates before clearing is triggered

In addition to setting a 150% pledge, MakerDAO also sets a 13% penalty rule for clearing. In other words, the liquidated borrower receives only 87% of the replacement assets. 3% of the fine goes to the liquidator and 10% goes to the platform. The purpose of this mechanism is to encourage borrowers to monitor collateral assets to avoid liquidations and penalties.

How will clearing affect the market?

When the crypto market is thriving, it attracts the attention of institutions and large users, and its heavy position is a “safety drug” for all investors. In the current downtrend, former bull market promoters are lined with black birds with liquidable derivative assets. Even more scary is the number of these crypto assets at a glance in transparent systems on the chain.

For institutions

When it suffers from full liquidation, it can cause a chain reaction of related protocols, institutions and others, in addition to bringing more sales pressure. This is because the loss gap between the lending position and the collateral assets is forced to be borne by these protocols and institutions, which puts them in a spiral of death.

For example, when stETH was unanchored, the CeFi agency Celsius was severely affected, exacerbating liquidity issues and causing large-scale executions for users. Financial institutions were forced to sell stETH in response to user requests for redemption of assets and could not withstand the pressure to eventually suspend account withdrawals and transfers. Similarly, Three Arrows Capital holds a large lending position in Celsius, and the difficulty of protecting itself in Celsius will undoubtedly affect Three Arrows Capital’s asset stress problems until it collapses.

For DeFi protocol

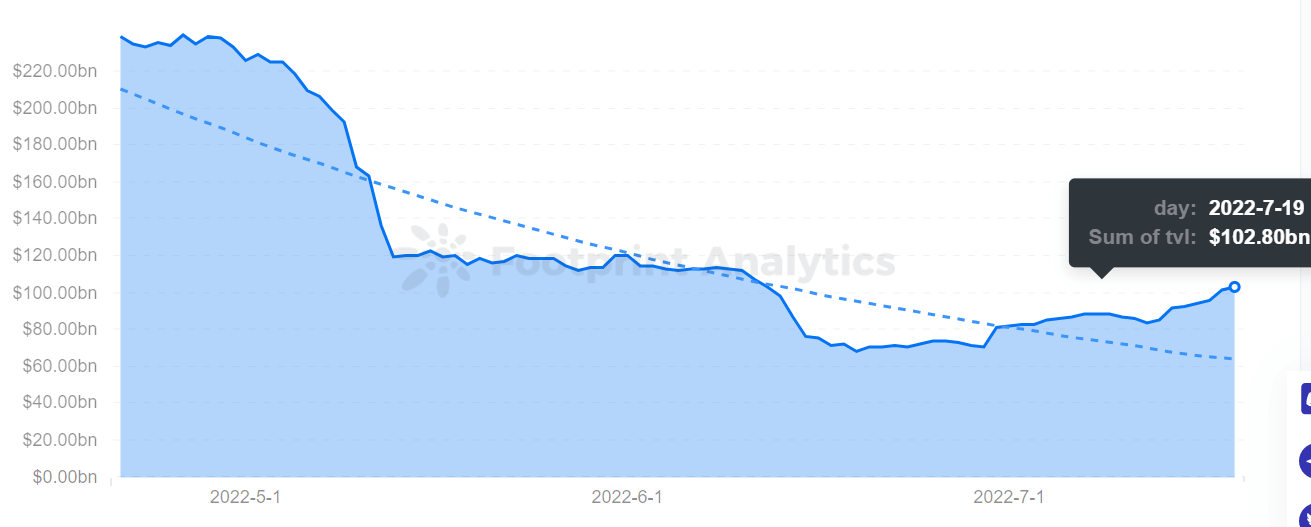

If the price of the currency drops and the value of the asset bet by the user on the platform falls below the clearing line (the mechanism for setting clearing varies from platform to platform), the bet asset will be cleared. Of course, users quickly sell risky assets to avoid liquidation in a recession.This also affects DeFi TVLTVL has dropped by 57% in the last 90 days.

If a protocol cannot withstand the pressure of execution, it faces the same risks as an institution.

For users

When a user’s assets are liquidated, in addition to losing ownership, they are also subject to fees or penalties charged by the Platform.

Overview

Like traditional financial markets, cryptocurrency markets are equally cyclical. The bull market doesn’t last forever, and there is no bear market. At each stage, it is important to carefully monitor your assets to avoid liquidations that can lead to a spiral of loss or death.

In the crypto world, we adhere to the rules of smart contracts, so shouldn’t a resilient economy do this?

This work has been contributed by Footprint analysis Community July.2022 by Vincy

Data Source: Footprint Analysis- ETH clearing dashboard

The Footprint Community is a place for data and crypto enthusiasts around the world to understand and gain insights into Web3, Metaverse, DeFi, GameFi, or other areas of the new world of blockchain. Here, lively and diverse voices support each other and move the community forward.