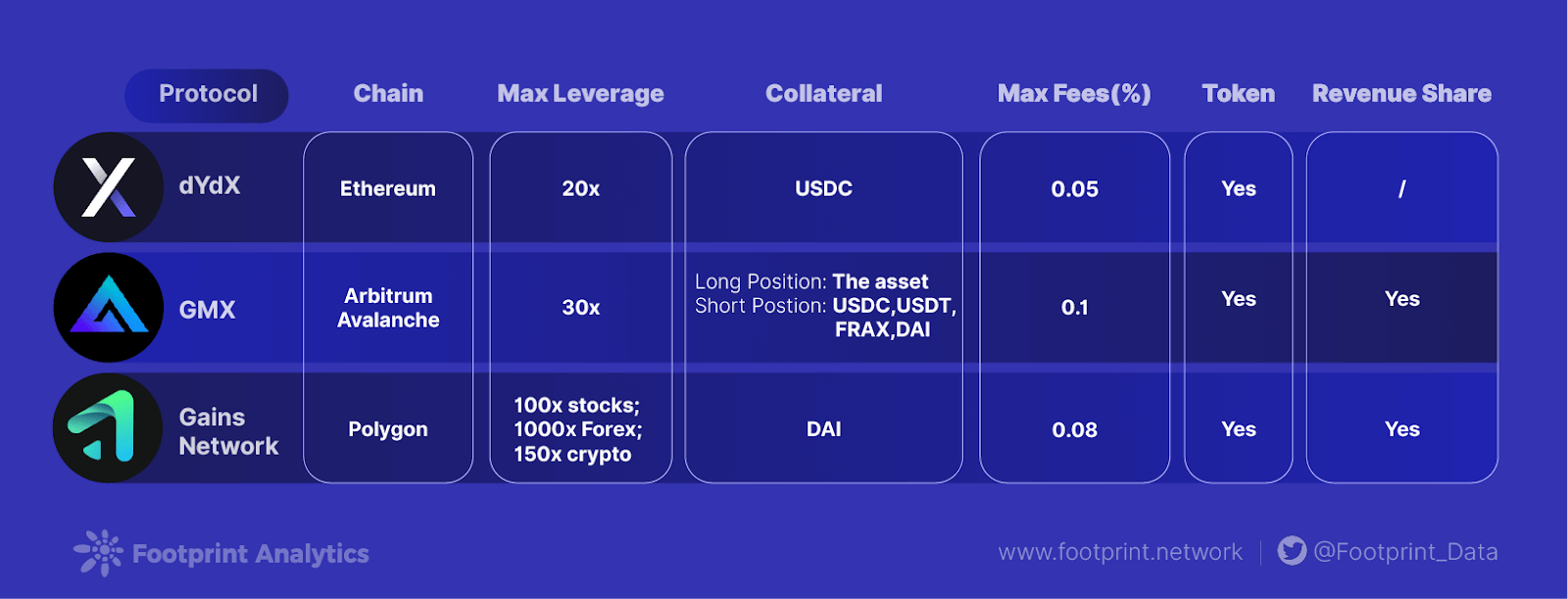

What Features Differentiate the Top Perpetual Futures DEXs?

in the financial system, A perpetual futures contract, also known as a perpetual swap, is a contract that represents a contract to buy or sell an asset at an unspecified time in the future.Users can also trade using margin or leverage (using borrowed funds).

This means that rather than having capital to trade a large nominal value of the underlying asset (say 500 ETH), users can leverage their capital and deposit a portion of it. Users can trade in both directions by buying (long) and selling (short) perpetuals. In other words, the user is using borrowed funds to bet on the future price of the asset.

Perpetual futures are a solution enabling derivatives markets for illiquid assets. It gained popularity when it was introduced by BitMEX in 2016. Cryptocurrency perpetuals typically offer high leverage, sometimes offering margins of 100x or more. By 2022, these products on centralized exchanges such as Binance, Kraken and BitMEX will generate billions of daily trading volumes, surpassing even spot crypto trading. However, there are now also decentralized platforms for perpetual markets.

This article discusses relevant players in the Perpetual DEX sector, comparing their key features and key metrics.

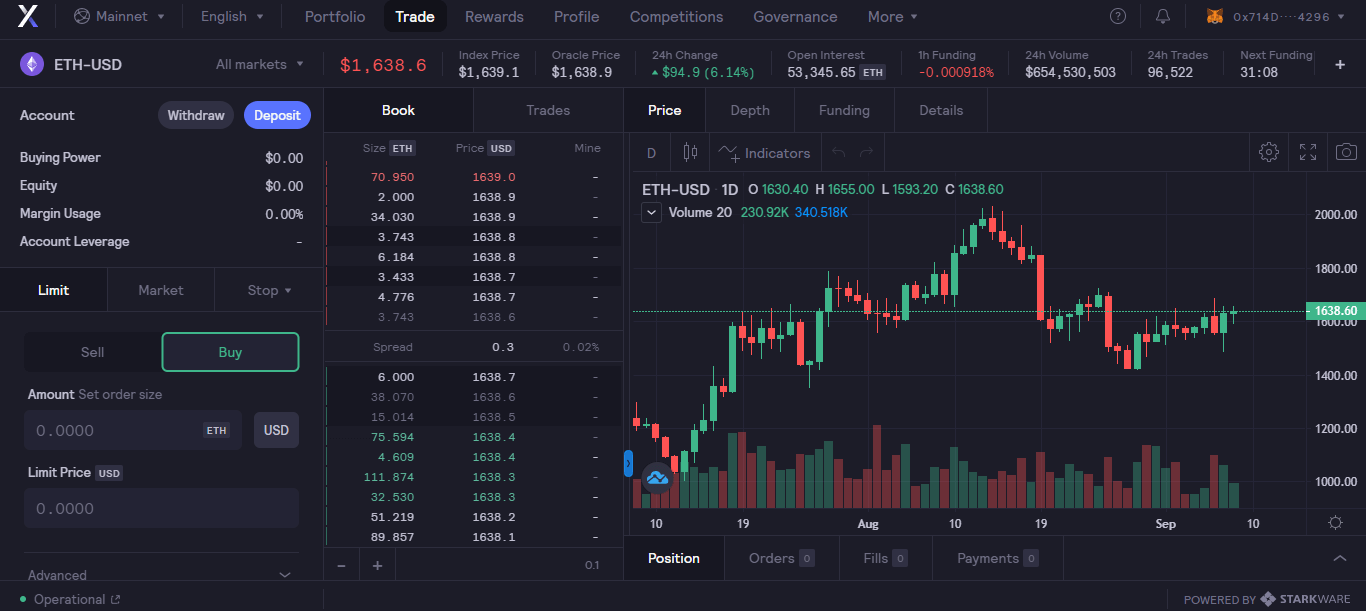

dYdX

Launched in 2017, dYdX is a DEX that runs smart contracts on Ethereum and offers perpetual contract trading, margin trading, spot trading, lending and borrowing services.

Users deposit collateral on the dYdX exchange and start trading perpetual contracts.

But it’s not the only way investors can interact with exchanges. He can deposit his USDC into the exchange’s trading pool (thus becoming a liquidity provider) and receive a yield on that capital.

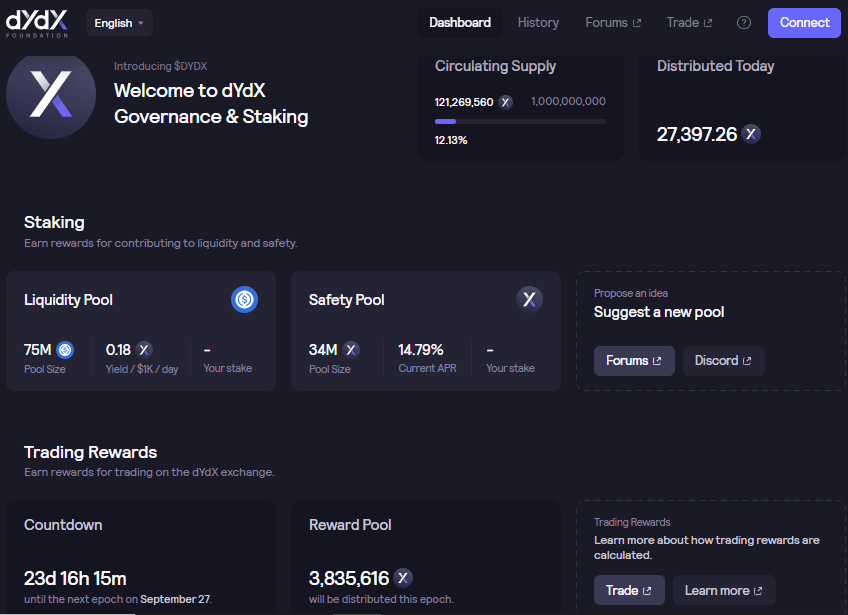

dYdX Rewards

The exchange has tokens (dYdX) that you receive as a reward for being a liquidity provider in the liquidity pool and can be staked as part of the protocol’s safe pool. The latter currently yields 14.79% APR.

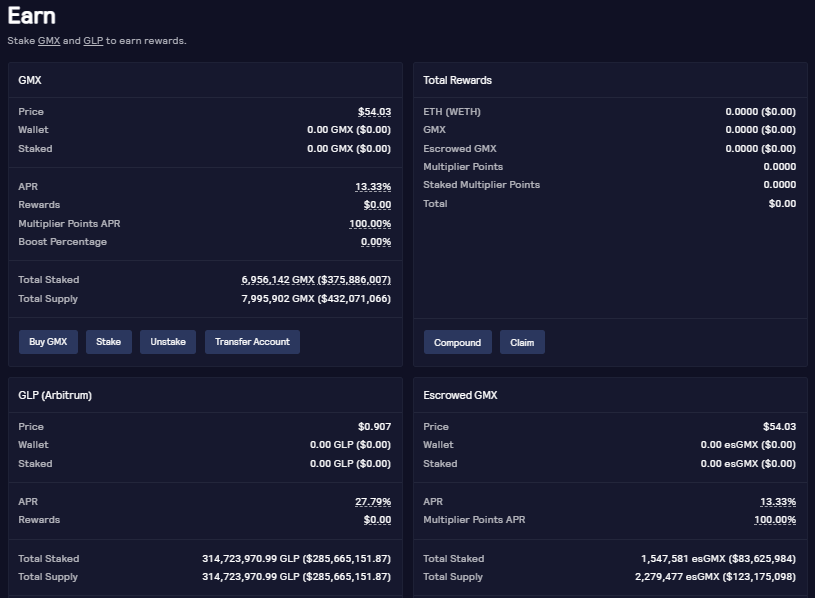

GMX

GMX is decentralized platform For spot and perpetual contract trading, allowing users to take advantage of up to 30x leverage in trading. The protocol will start him in Arbitrum in September 2021 and in early 2022 he will enter Avalanche.

Similar to dYdX, investors can also contribute liquidity to GMX’s trading pool and receive rewards. One difference is that you can send UDSC and other tokens (BTC, USDT, DAI, etc.) to the pool. Another difference is that the platform has his two tokens, GMX and GLP.

GMX Reward

Investors can buy GMX, stake it and collect shared earnings from the protocol. GMX is a token used for governance. GLP is given to investors who provide liquidity to the protocol and can also bet on it. Fees are split between his GMX (30%) and GLP (70%).

gain network

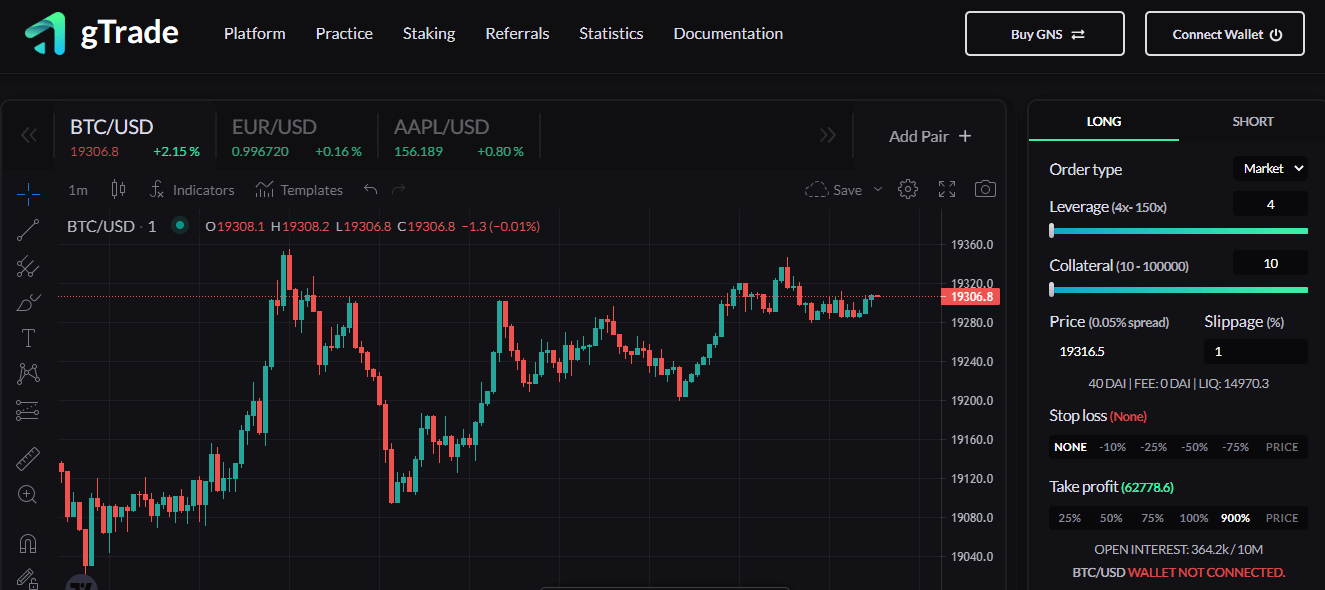

Gains Network is a decentralized perpetual exchange on Polygon. Launched gTrade, a decentralized leveraged trading platform using synthetic assets. Unlike dYdX and GMX, these synthetic assets allow us to offer a wide range of leverage and pairs (up to 150x for cryptocurrencies, 1000x for forex, and 100x for stocks).

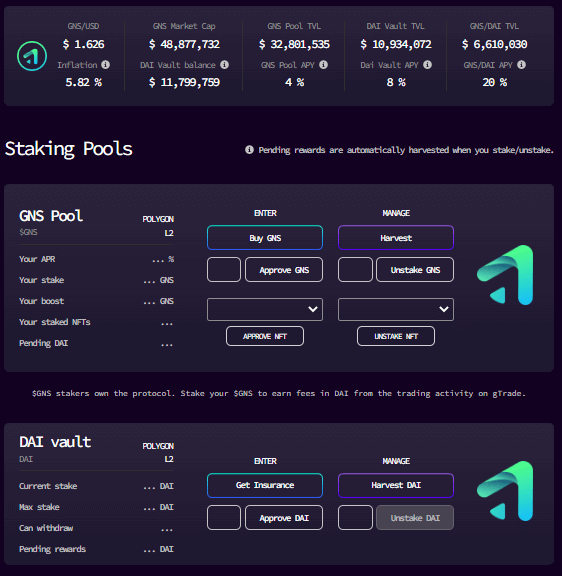

Gains Network also allows investors to provide liquidity to the treasury (DAI in this case) that is used as a counterpart for their trading activity and receive rewards/earnings from the platform.

Earn network rewards

There are two tokens in this protocol, the ERC-20 Token (GNS) and the ERC721 Utility Token (NFT). GNS and NFT were created to be actively used within the platform. GNS holders receive platform fees paid in DAI when staking through Single Sided Staking. NFT holders will receive reduced spreads and increased rewards in addition to the usual.

Key metrics and features

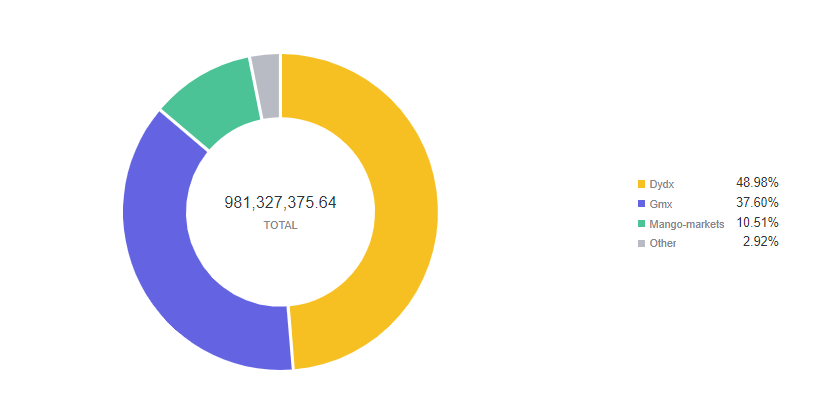

TVL

dYdX (US$468 million) and GMX (US$360 million) dominate TVL’s DEX Perpetual landscape, with nearly 87% of the market. One has cemented itself as a first mover (dYdX), another is a new entrant who has been able to acquire new users better using the “revenue sharing” strategy, and others like other exchanges. was implemented by the exchange of gain network.

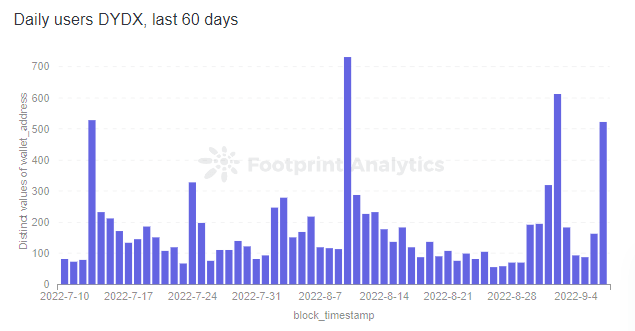

daily user

dYdX

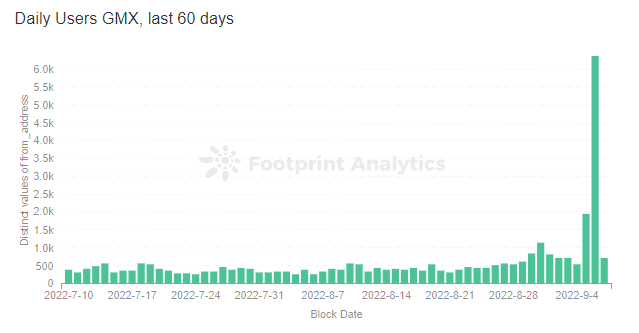

GMX

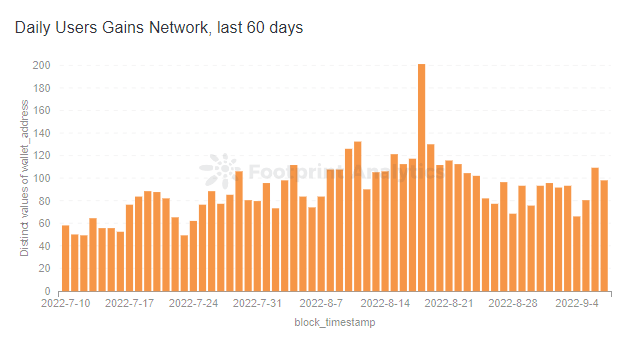

gain network

Over the past 60 days, GMX has more daily users (average 500) than dYdX (average 200), while Gains Network (average 80) is approaching dYdX’s numbers. All platforms encourage trading. DYdX is Trading Rewards Program, users will receive dYdX tokens based on their trading activity. GMX is Referral program Encourage new user onboarding and generate discounts for new users and rebates for referral code holders. Gains Network too Referral program To increase the average number of users per day.

important point

As seen in the chart above, dYdX and GMX are the most prominent players in the DEX perpetual market vertical. However, new entrants like Gains Network have new features (more leverage, more trading pairs) and are looking to increase their TVL. The ability to use more leverage and support for more collateral types, combined with revenue sharing to token holders, is a good step towards major adoption.

Contributors to this work are footprint analysis community.

September 2022, Thiago Freitas

Source: Comparison of dYdX & GMX $ Gain Networks

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or any other area of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.

Footprint website: https://www.footprint.network

discord: https://discord.gg/3HYaR6USM7

twitter: https://twitter.com/Footprint_Data