Why some hedge funds are shorting U.S. banks

The U.S. banking market recently experienced an annual stress test Implemented by the Federal Reserve. Aimed at assessing banks’ resilience in the face of economic downturns, the study uncovered a range of findings that could have far-reaching implications for the cryptocurrency market, and Bitcoin in particular.

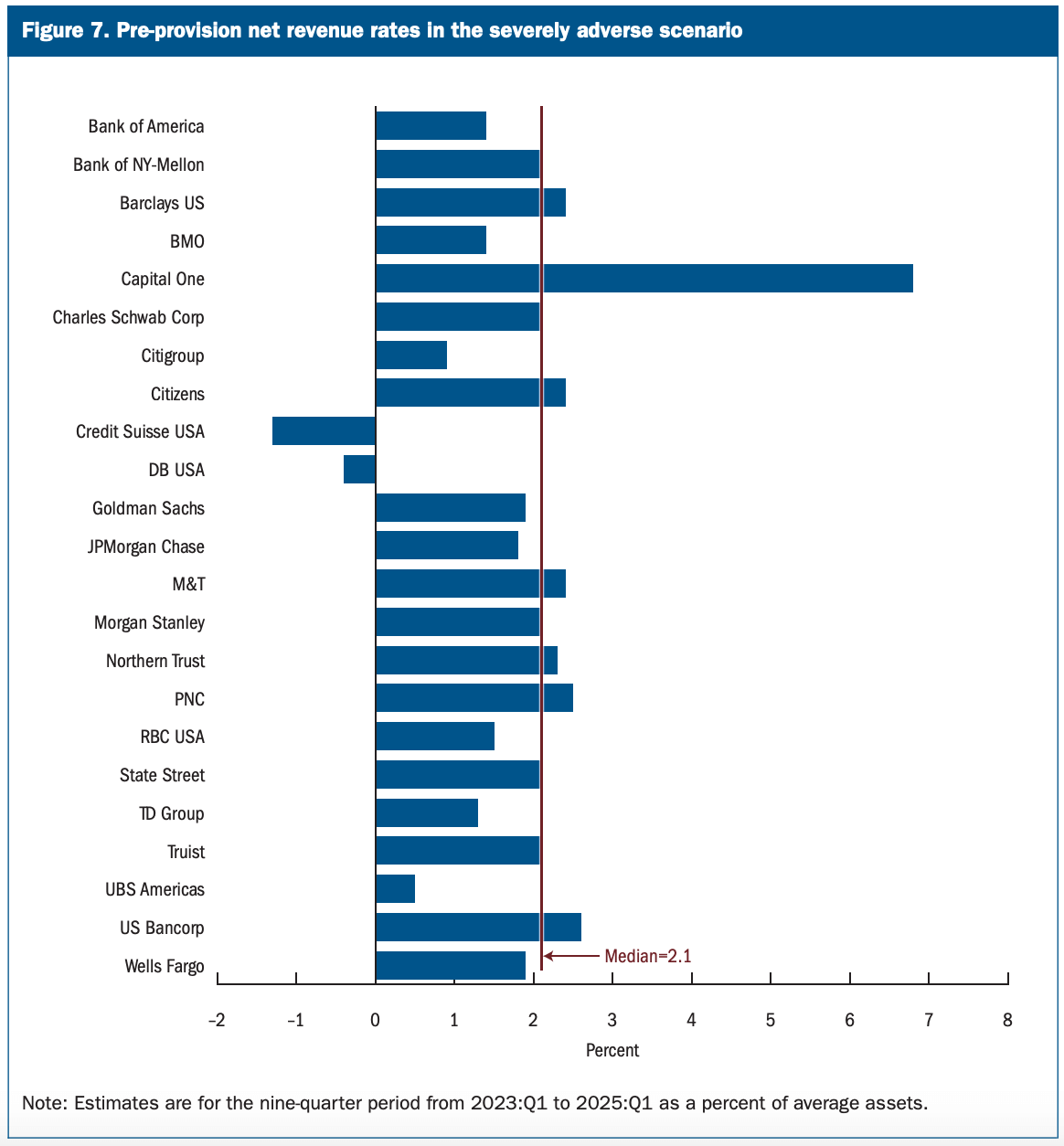

A stress test is a simulation used to assess how a bank would react during a financial crisis. A recent test showed that banks experienced the maximum stressed capital drawdown on average at 2.3%. The 2.3% figure is the lowest in years and suggests banks are more resilient to financial stress than in the past.

Some banks saw larger drawdowns, notably Capital One Financial and US Bancorp. This means that it could face a higher stress capital buffer (SCB), assuming the dividend stays the same. SCB is additional capital that a bank must hold to absorb losses and continue operations during a financial crisis.

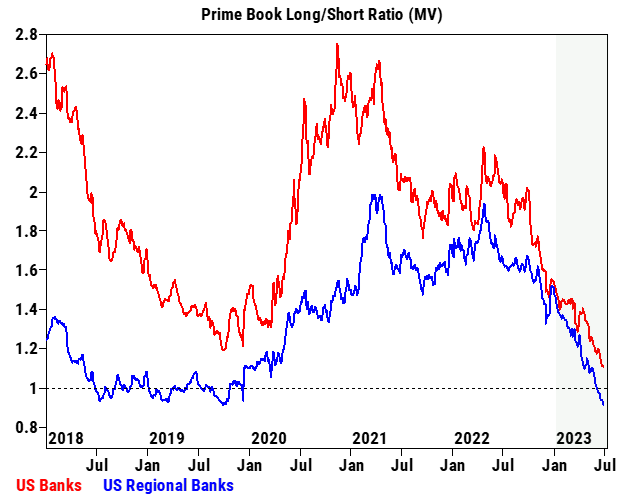

Mixed stress test results have not deterred hedge funds from aggressively backing U.S. banks, especially regional ones. Regional banks have the highest exposure to commercial real estate, according to Goldman Sachs Prime Brokerage data, a sector that has seen more volatility since the coronavirus pandemic.

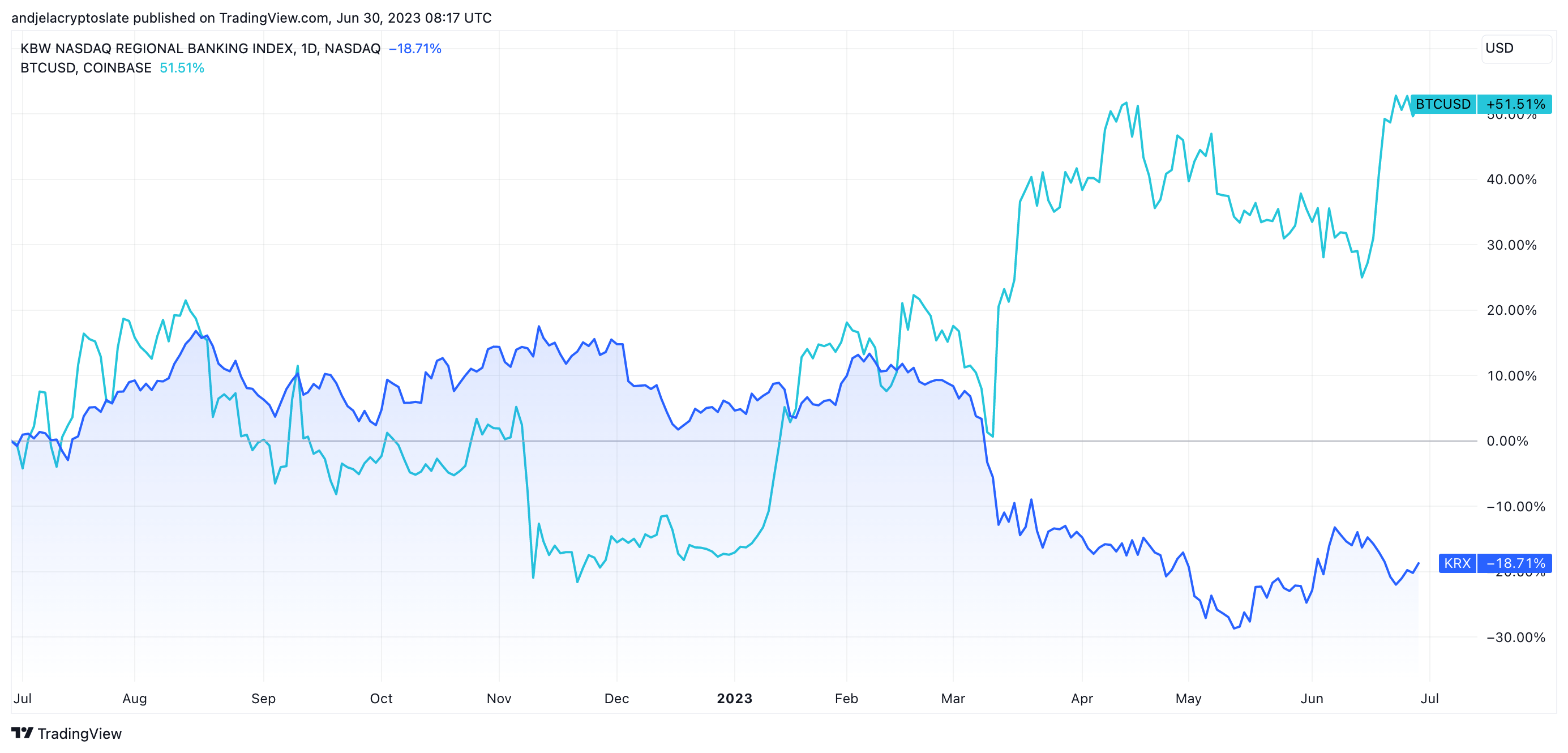

The health of the banking industry is crucial to Bitcoin and the broader cryptocurrency market.

Banks provide the infrastructure for fiat-to-crypto trading, and the stability or volatility of banks can affect investor sentiment towards cryptocurrencies. If an increase in bank short selling leads to a downturn in the banking sector, investors may turn to Bitcoin as a safe haven asset.

If these short sales lead to major market turmoil, it could create a risk-off environment that could adversely affect Bitcoin.

However, cryptocurrency markets have often thrived amid volatility in traditional markets. Bitcoin in particular has historically served as a hedge against traditional market fluctuations. Therefore, an increase in bank short selling could increase the appeal of Bitcoin as an alternative investment.

On the other hand, volatility in the banking sector could increase regulatory scrutiny and create liquidity issues for cryptocurrencies. Banks facing significant stress may withdraw from servicing cryptocurrency businesses, impacting the ease of fiat-to-crypto transactions.

This could hurt bitcoin in the short term, as the market is likely to experience reduced liquidity for several weeks, increasing selling pressure.

This post first appeared on CryptoSlate on why some hedge funds are shorting US banks.