Worst-case scenario could see up to 1.54M ETH becoming liquid after Shanghai upgrade

quick take

The market has been filled with speculation about the impact on Ethereum’s price as Ethereum’s Chapela upgrade is due in the next few hours.

The Shapella upgrade is a name that combines two upgrades: the Shanghai upgrade, which implements changes to Ethereum’s execution layer, and the Capella upgrade, which implements changes to Ethereum’s consensus layer.

Among the few minor upgrades to gas pricing, Shapella’s significance lies in its ability to give users and validators access to staked ETH.

Validators have two options when withdrawing their staked ETH: partial and full.

Partial withdrawal

The Shanghai upgrade will allow validators to withdraw only a portion of their ETH stake, reducing the validator’s balance to the required 32 ETH.

The excess balance that can be partially withdrawn is approximately 1,137,000 ETH, worth approximately $2.1 billion at the time of writing. This is an excess validator balance that does not need to participate in Ethereum’s Proof-of-Stake consensus mechanism.

However, only validators with withdrawal credentials oxo1 can partially withdraw their wagers. According to CryptoSlate’s analysis, this is around 44% of validators who can withdraw around 276,000 ETH.

full withdrawal

A full withdrawal involves closing the entire validator to restore stake balance.

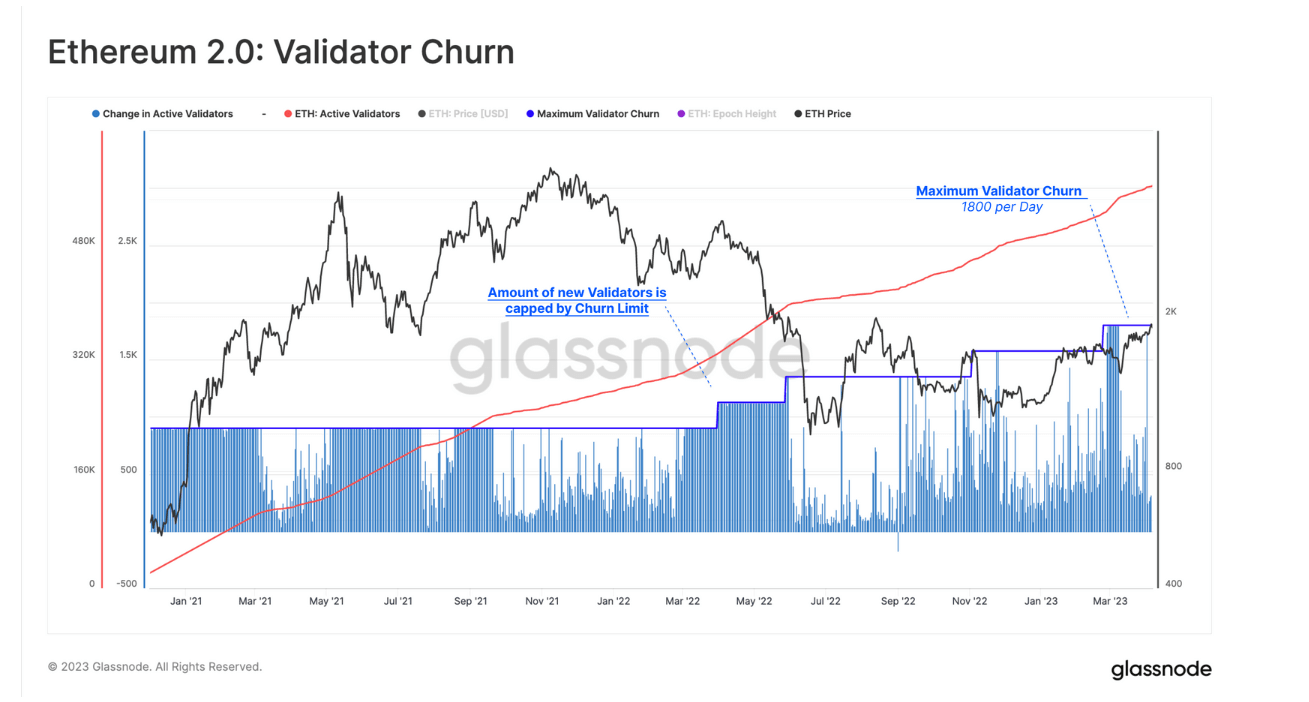

Since the Ethereum network relies on a stable set of validators, only up to 1,800 validators can be fully withdrawn each day. This limit is based on a churn specification of 8 validators per epoch for 225 epochs per day.

This mechanism allows you to fully withdraw up to 57,600 ETH (worth about $109 million at the time of writing) per day.

Around 170,000 ETH (worth $323 million at press time) could be sold in the days following the Shanghai upgrade, according to Glassnode’s latest estimates. In Glassnode’s worst-case scenario, up to 1.54 million ETH could be sold this week, worth just over $2.93 billion.

In a later worst-case scenario, up to 1.54 million ETH could be liquidated after the Shanghai upgrade first appeared on CryptoSlate.