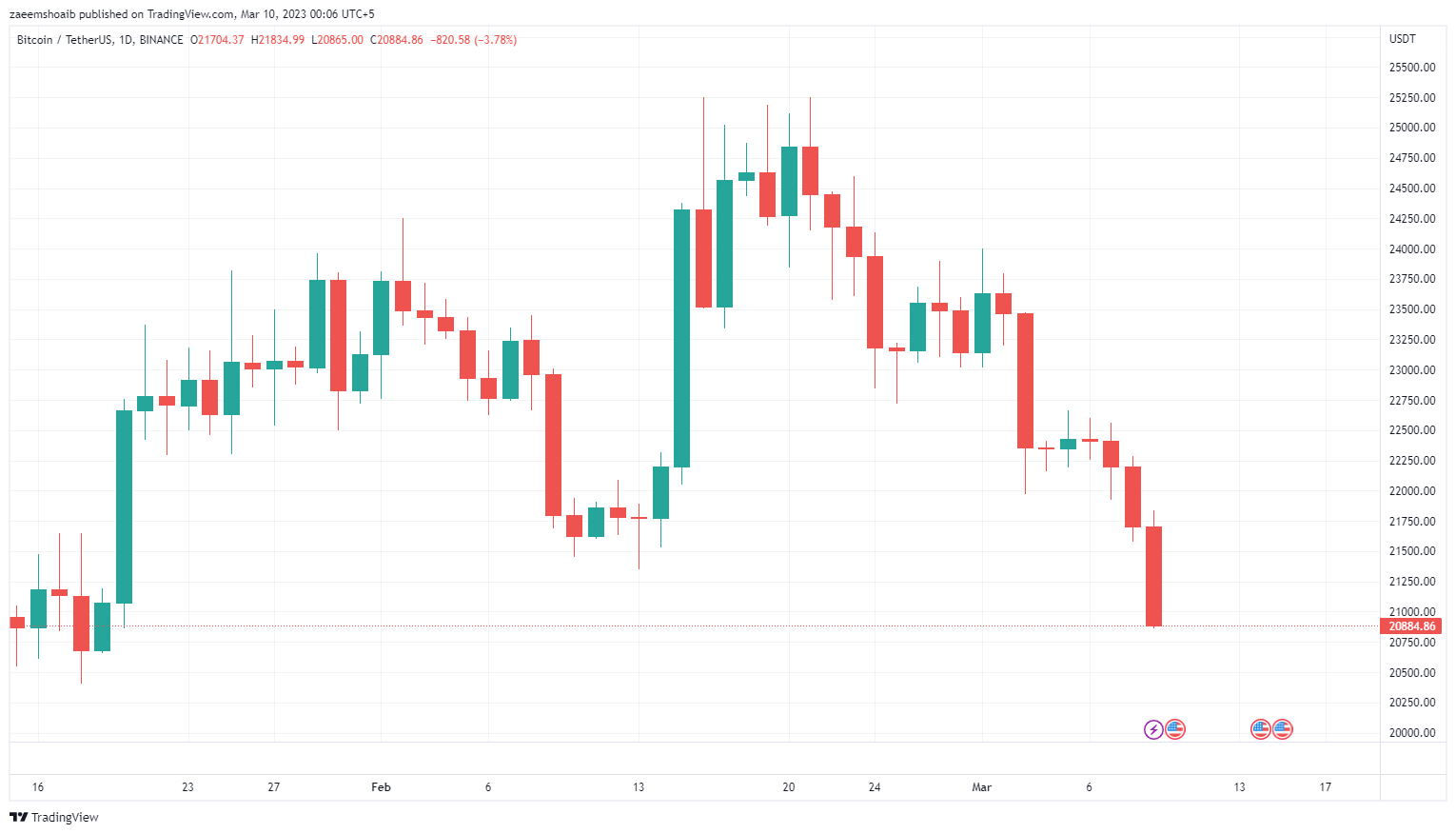

Bitcoin loses $21k support and sheds 5% in 24H trading

Bitcoin has lost critical support at the $21,000 level as market volatility continues after the collapse of Silvergate.

On Thursday, cryptocurrency prices experienced a decline after Silvergate, a prominent bank in the industry, announced its decision to shut down. Coin Metrics reported that bitcoin has fallen 6% on him, taking him below $21,000 support for the first time since Jan. 17.

Silvergate continues to haunt $BTC

Some investors have found bitcoin’s recent sideways move promising, but given a string of negative industry developments, chart analysts are now at about 30% early in the year. We expect the cryptocurrency to close above $25,000 to give more weight to future gains.

The decline started late Wednesday after Silvergate Capital announced its intention to scale back operations and liquidate its crypto-friendly bank. But the magnitude of the decline is already making news to cryptocurrency market investors when Silvergate issued its first warnings last week about the possibility of shutting down the Silvergate Exchange Network (SEN), ceasing operations. suggests that it has taken into account

Additionally, a joint warning to banks by the Fed, FDIC, and OCC last week added to the unease surrounding the industry about the liquidity risks associated with banking crypto firms.

FTX and broader regulatory hurdles

Macro conditions are also putting downward pressure on Bitcoin, with ongoing lawsuits in the US over FTX, and several cryptocurrency laws currently being debated. The world’s oldest cryptocurrency appears to be going through a cycle of fear, uncertainty and doubt.

Decrease in bitcoin quantity

Following the collapse and voluntary liquidation of Silvergate Bank, bitcoin traders are pausing and evaluating their next move. Total number of transactions on blockchain decreased by 17%. Additionally, data from Crypto Quant shows a 10% decrease in the number of active addresses.

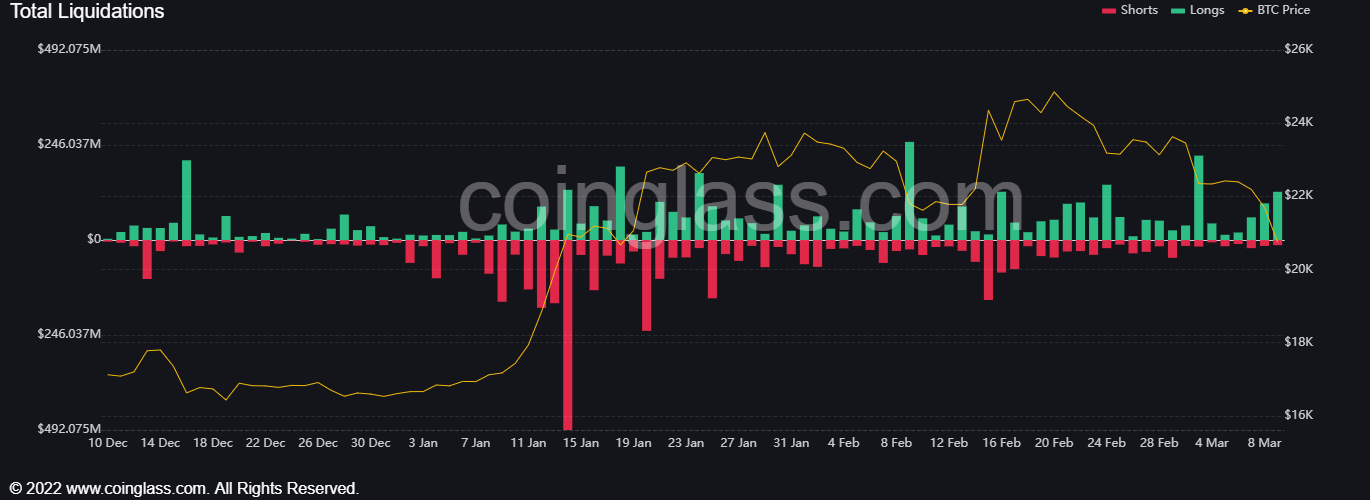

BTC clearing

On March 8, the Coinglass watchdog resource reported that $24.4 million worth of BTC longs had been liquidated, marking the highest number in almost a week. In total, including altcoins, $95 million long and his $15.4 million short liquidated on March 8.

Glassnode, an on-chain analytics firm, provided additional data showing the predominance of long-term liquidations over short-term liquidations.

According to CoinGecko data, bitcoin trading volume averaged about $25 billion in March, compared to about $36 billion in February. Paris-based crypto data his provider Kaiko said on Monday: memo Since traders deposit dollars into stablecoin issuers, receive stablecoins, and transfer them to exchanges, the collapse of Silvergate is likely to lead to even more stablecoin adoption among traders. Desk reported.