Bitcoin rises amidst string of bank failures: is this the start of a new financial era?

On May 1, US regulators seized the First Republic Bank (Fed) and its assets and sold them to JP Morgan. It was the largest bank failure since 2008. The Fed is his fifth bank, after Silvergate, to fail within two months. Silicon Valley Bank, Signature Bank, Credit Suisse.

Despite the growing number of banks in trouble, regulators continue to assure the public that these failures are not part of the global banking crisis.

Sources close to Treasury Secretary Janet Yellen Said CNN said First Republic is an outlier in the regional banking sector. The first-quarter results showed that nearly all midsize and regional banks were “well-capitalized” and had steady deposit flows, the sources claimed.

JP Morgan CEO Jamie Dimon agreed with the statement, assuring participants of recent investor calls that the banking sector is “stable.”

“There is no perfect crystal ball, but I think the banking system is very stable. This part of the crisis is over.”

bend the banking system

But the failures of First Republic, Signature and Silicon Valley Bank are already bigger than the 25 banks that failed in 2008.

The three banks had more than $530 billion in assets, while Washington Mutual and 24 other banks that failed in 2008 managed about $524 billion, according to The New York Times data. We adjust the data for inflation.

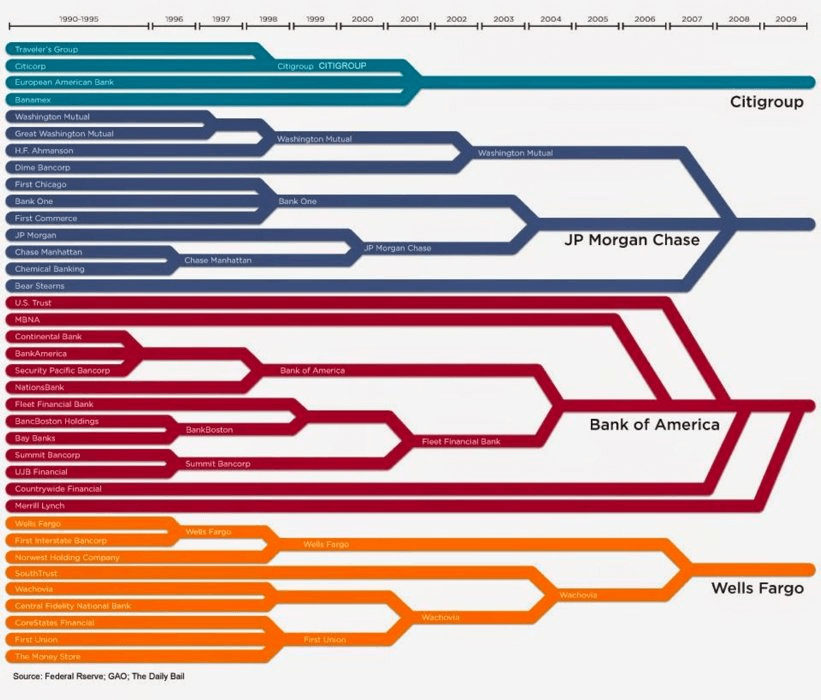

JP Morgan’s acquisition of First Republic was hailed by U.S. regulators as a heroic move that saved taxpayers from facing bill failure. But it sets a dangerous precedent for the US market to become dangerously centralized and government dependent.

There is no explicit law prohibiting banks from controlling any percentage of the country’s total deposits, but safeguards are in place to prevent systemic banking problems. Passed in 2010 in response to the 2008 financial crisis, the Dodd-Frank Act allows regulators to prevent mergers and acquisitions that make banks “too big to fail.”

Many economists and analysts have warned that JP Morgan’s takeover of First Republic should never be allowed. In his controversial $10 billion deal, JP Morgan acquired most of his Fed assets and took over deposits (both insured and uninsured) from the FDIC.

This takes JP Morgan’s total assets to over $3.2 trillion, cementing its position as the largest bank in the United States.

As part of the transaction, JP Morgan acquired $173 billion in loans and $30 billion worth of securities from the Fed. It also envisions approximately $92 billion in deposits, including $30 billion in large bank deposits, all of which will be repaid after the transaction closes. The FDIC will share JP Morgan’s losses on $13 billion worth of residential and commercial loans and provide $50 billion in funding to JP Morgan.

Bitcoin

At the other end of the financial spectrum is Bitcoin, which appears to have taken advantage of the ongoing banking crisis to lay a strong foundation for the rest of the year.

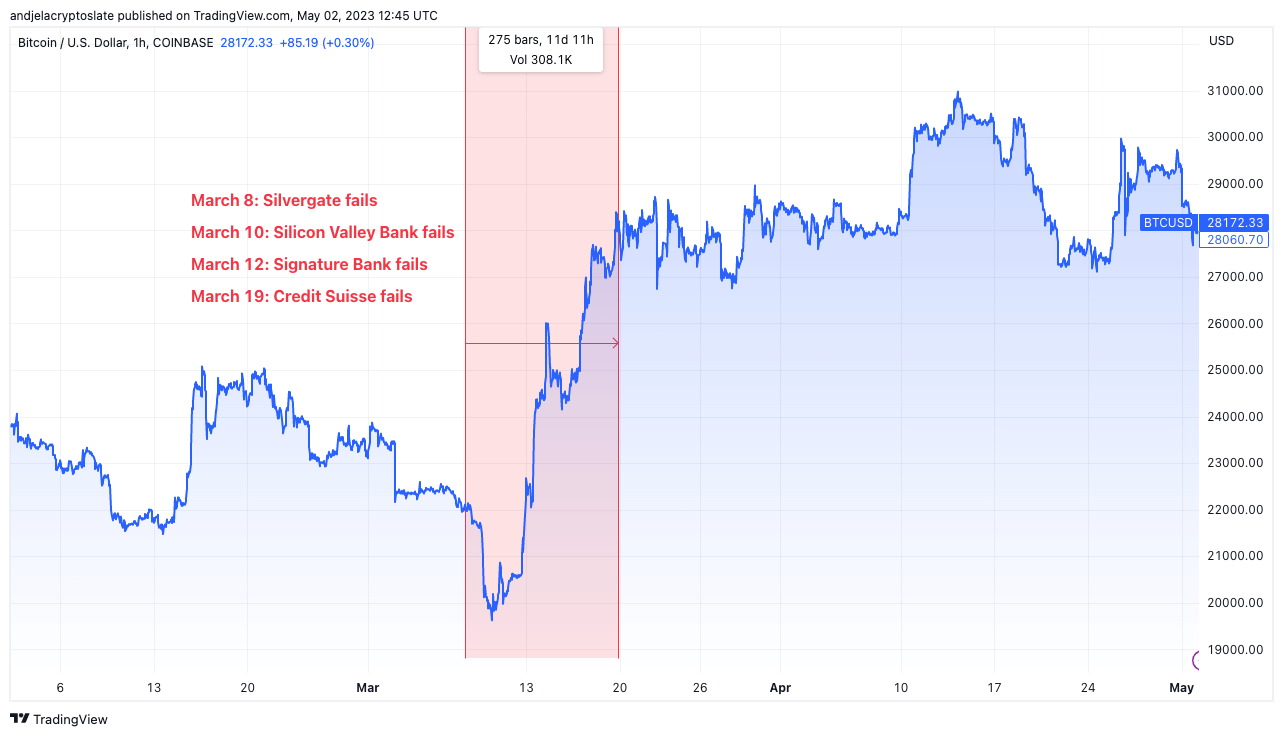

The four consecutive bank failures that occurred between March 8th and March 18th of this year impacted the price of Bitcoin, wiping out nearly 17% of its market cap. However, the effect was short-lived, with Bitcoin quickly beginning to recover from the initial shock, and within three days he had recovered his 17% loss.

Bitcoin’s price has risen since then, with BTC trading just over $28,000 at the time of writing. The volatility experienced by BTC when it crossed $30,000 and a consistent correction around $27,000 could mean that strong resistance has formed.

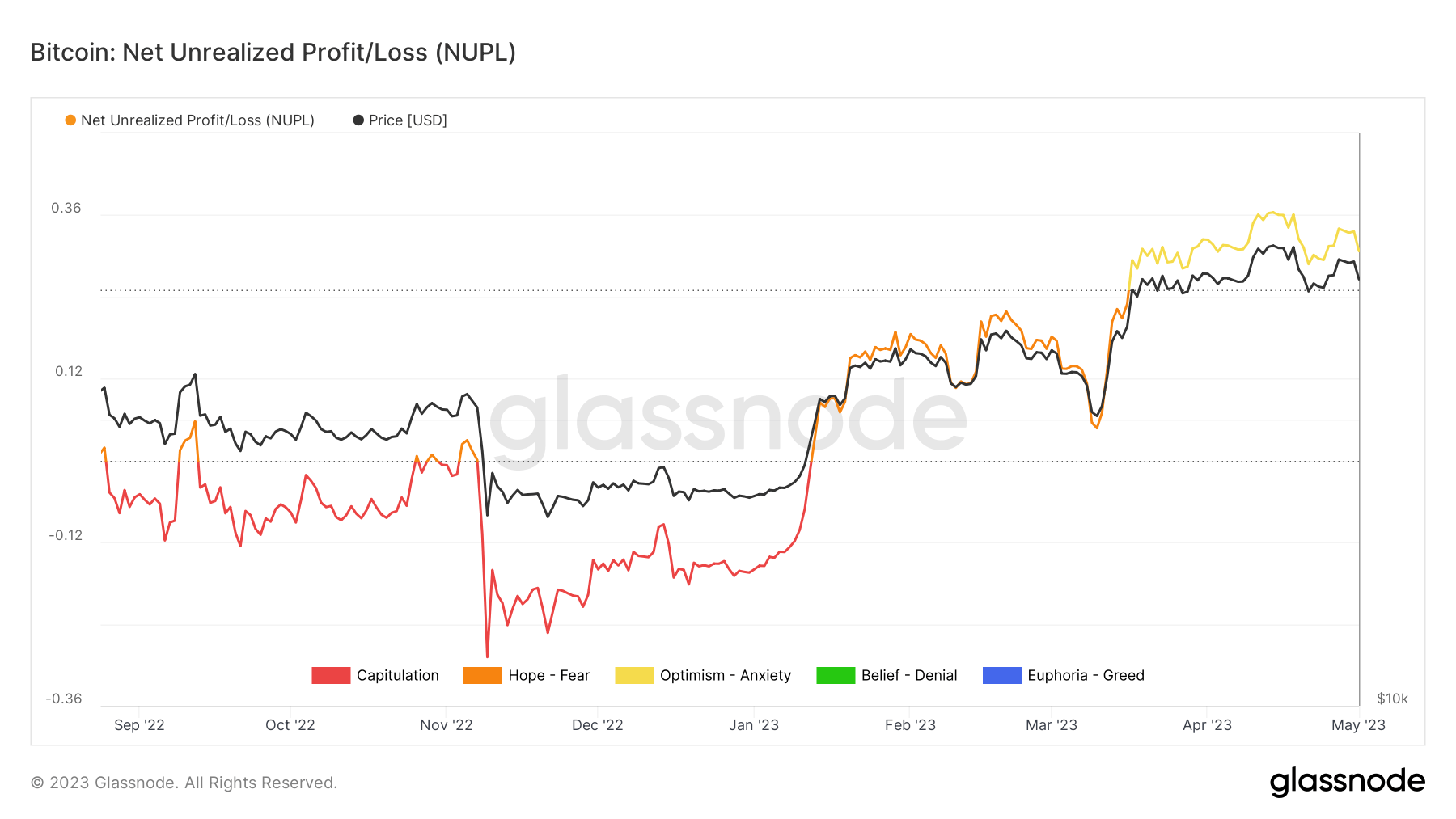

The bank failure also seems to have brought much-needed optimism to the cryptocurrency market. Net Unrealized Profit/Loss (NUPL) is a metric used to determine if the entire network is in profit or loss. The higher the NUPL score, the more unrealized profit in the network and the more optimistic the network as a whole about future price action.

look at bitcoin NUPL The scores show that the scare similarities brought on by the failures of Silvergate, Signature, and Silicon Valley Bank were quickly wiped away.

Bitcoin Rises Amid a Series of Bank Crashes: Is This the Beginning of a New Financial Era? First Appeared on CryptoSlate.