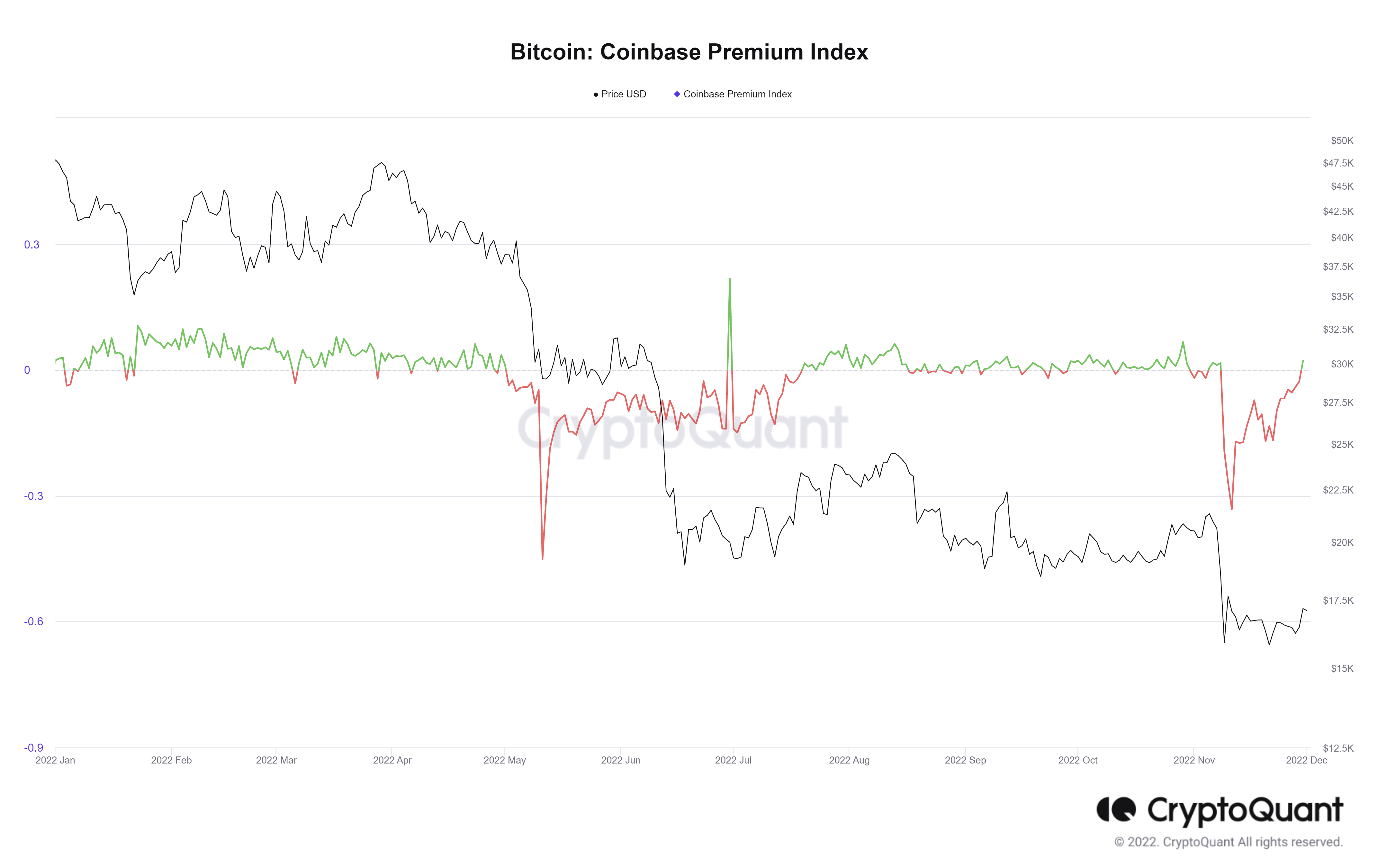

Coinbase Premium Index goes green for the first time since FTX collapse

According to CryptoQuant, an on-chain data and analytics provider, the Coinbase Premium Index has turned green for the first time since the impact of the FTX collapse.

As Indicators showing signs of “whale accumulation” Coinbase Premium is the price difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair.

“For example. When the price of Bitcoin continuously breaks through 20,000, 30,000, 40,000 while Coinbase’s premium remains above $50. During these plunges, institutions or other whales It shows that it has accumulated.”

Coinbase Pro is considered a “gateway” for institutional purchases of cryptocurrencies, so Coinbase Premium is used to track the movements of institutional whales.

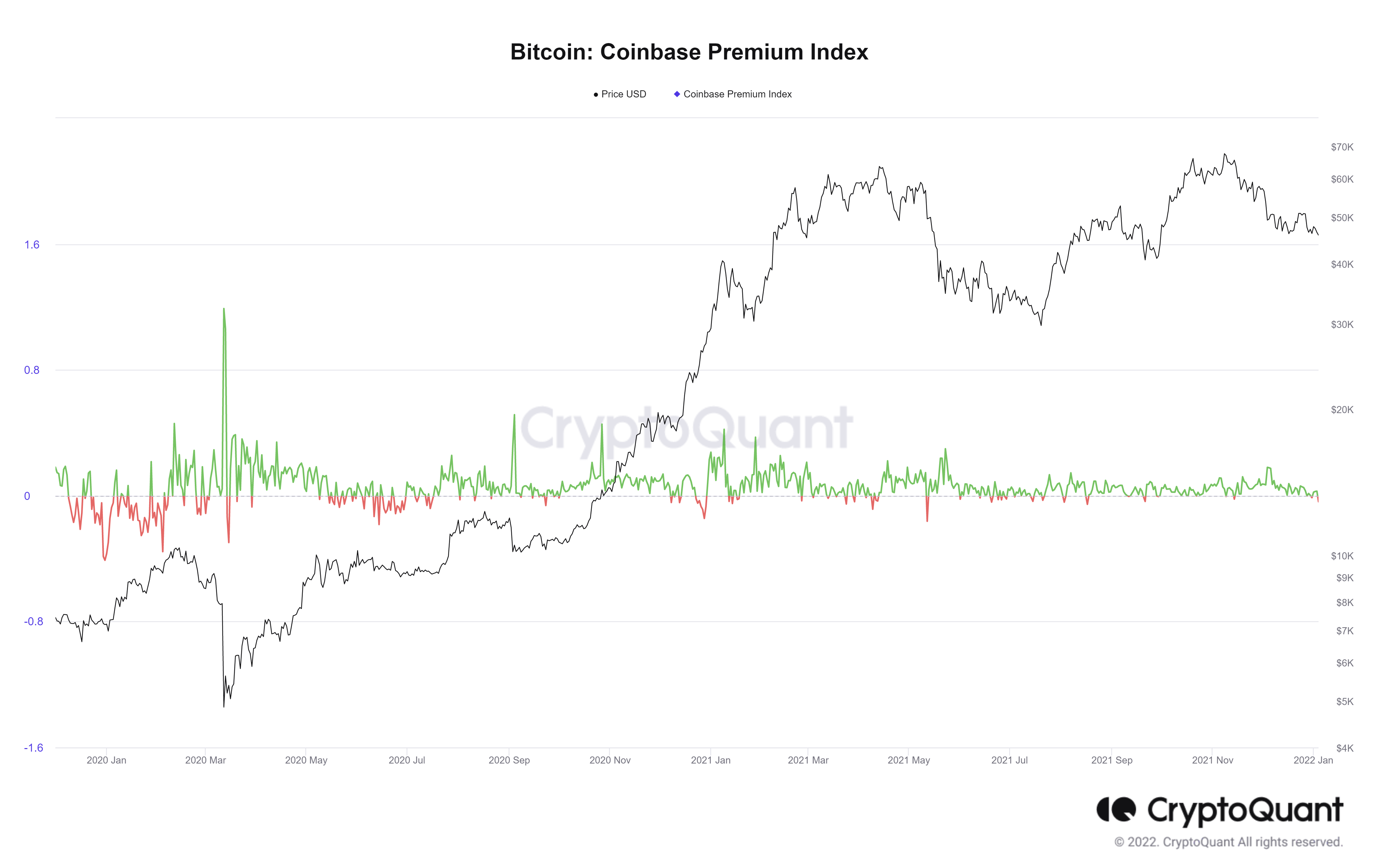

CryptoQuant situation “As the 2020 bull market was sparked by US institutional investors and HNWIs, it made investors check out Coinbase Premium more than ever.”

Historically, highs and lows in the Coinbase Premium Index indicate potential strong buying and selling from Coinbase.

For example, when the Coinbase premium reaches a high value, it indicates that Coinbase whales may be accumulating bitcoin regardless of the high price. However, the opposite is also true when the index drops to low values, indicating that coinbase whales are not buying or perhaps selling coins on a regular basis.

Looking back over the year so far, the Coinbase Premium Index flipped slightly between red and green. Sighted this year, he only strayed from this pattern during two major surrender events (Luna and FTX). This shows the level of uncertainty and lack of confidence from institutions this year compared to last year.