Glassnode report shows 2022 bear market is the worst in history

The latest of blockchain analysis company Glassnode report The bear market in 2022 is the worst in history, revealing that many investors are selling Bitcoin (BTC) holdings at discounted prices.

According to the report, Bitcoin’s below 200-day moving average, net realized losses, and negative deviations from the realized price make it the worst bear market in the history of cryptocurrencies.

The bear market in 2022 #Bitcoin When # Ethereum Investors realize huge capital loss.

Our latest study quantifies the severity of this bear and claims it is the most important in history.

Read more 👇https://t.co/FlSehPo3FB

— Glassnode (@glassnode) June 24, 2022

This is the first time on record that BTC and Ethereum (ETH) have traded below ATH in the previous cycle, which means a significant unrealized loss in the market. All investors who purchased BTC or ETH between 2021 and 2022 are now underwater.

While many investors are still holding up, financial pressures from liquidity restrictions and rising inflation have caused some investors to lose money and sell.

Bitcoin is below the moving average

According to the report, the first sign of the bear market is that Bitcoin prices have fallen below the 200-day moving average and, worse, below the 200-week MA. Bitcoin is trading at its current price at less than half of the 200-day MA level.

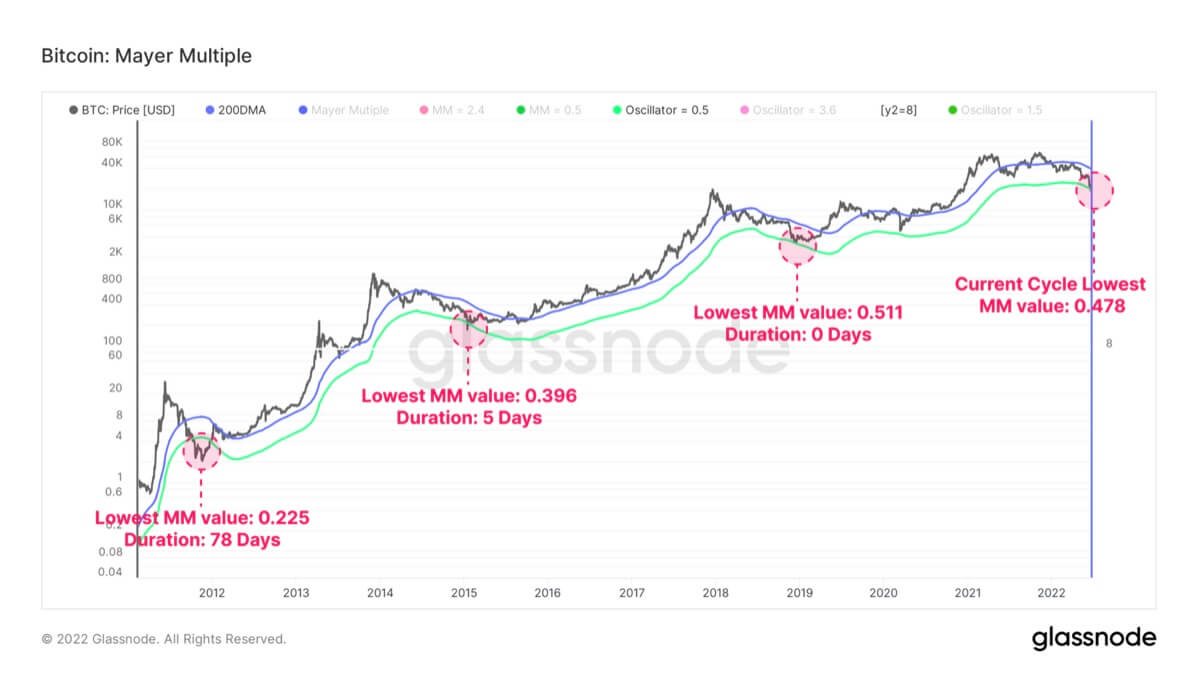

The report also points out that Bitcoin’s price has fallen below 0.5 Mayer Multiple (MM) for the first time since 2015. The MM for this cycle is now 0.487, which is much lower than the previous cycle of 0.511.

Mayer Multiple shows the oversold or overbought condition, taking into account price changes above and below the 200-day moving average. “Only 84 (2%) of the 4160 trading days closed below 0.5,” the report said.

In addition, the current market conditions are quite severe, reflecting the fact that spot prices have fallen below realized prices. Such instances are sporadic, and this is the fifth time since Bitcoin was launched in 2009.

According to Glassnode, only 13.9% of all Bitcoin trading days have spot prices below unrealized prices. He added that on the day Bitcoin fell below $ 20,000, investors posted a loss of $ 4,234 million.

Like Bitcoin, like Ethereum

Ethereum isn’t working either. Like Bitcoin, those who bought Ethereum in 2021 and earlier this year are suffering unrealized losses. Most of the decline in Ethereum prices is due to the de-leveraging of DeFi and its declining advantage since November 2021.

In addition, trading at a 63% discount on the 200-day MA, Mayer Multiple reached 0.37, below the downside deviation of the 0.6MM band. So far, tokens have been trading for only 29 days below this band, well below the 187 days of the 2018 bear market.

Based on all available data, Glassnode concludes this current market surrender event as follows:

It is one of the least important, if not the most important in history, both in terms of the severity, depth and scale of capital outflows and losses realized by investors.