On-chain metrics signal upcoming BTC volatility

Futures open interest rate and futures estimated leverage ratio indicators have reached their highest levels for more than a month, showing Bitcoin (BTC) volatility ahead, according to data analyzed by Glassnode. crypto slate.

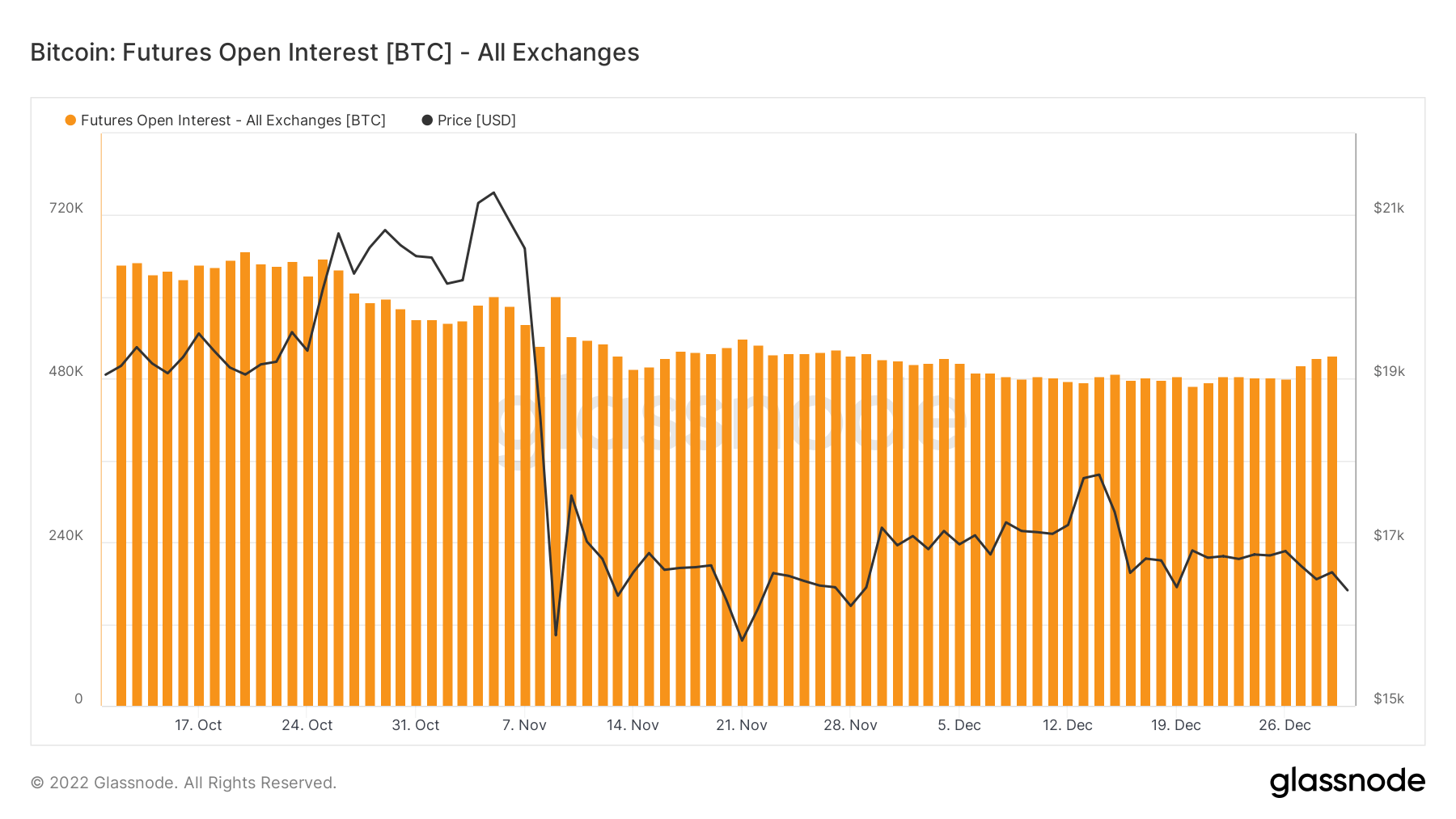

futures open interest

The Futures Open Interest Index reflects the USD value of the total amount of funds allocated to open futures contracts.

The chart above shows the daily BTC futures open interest since October 17th.

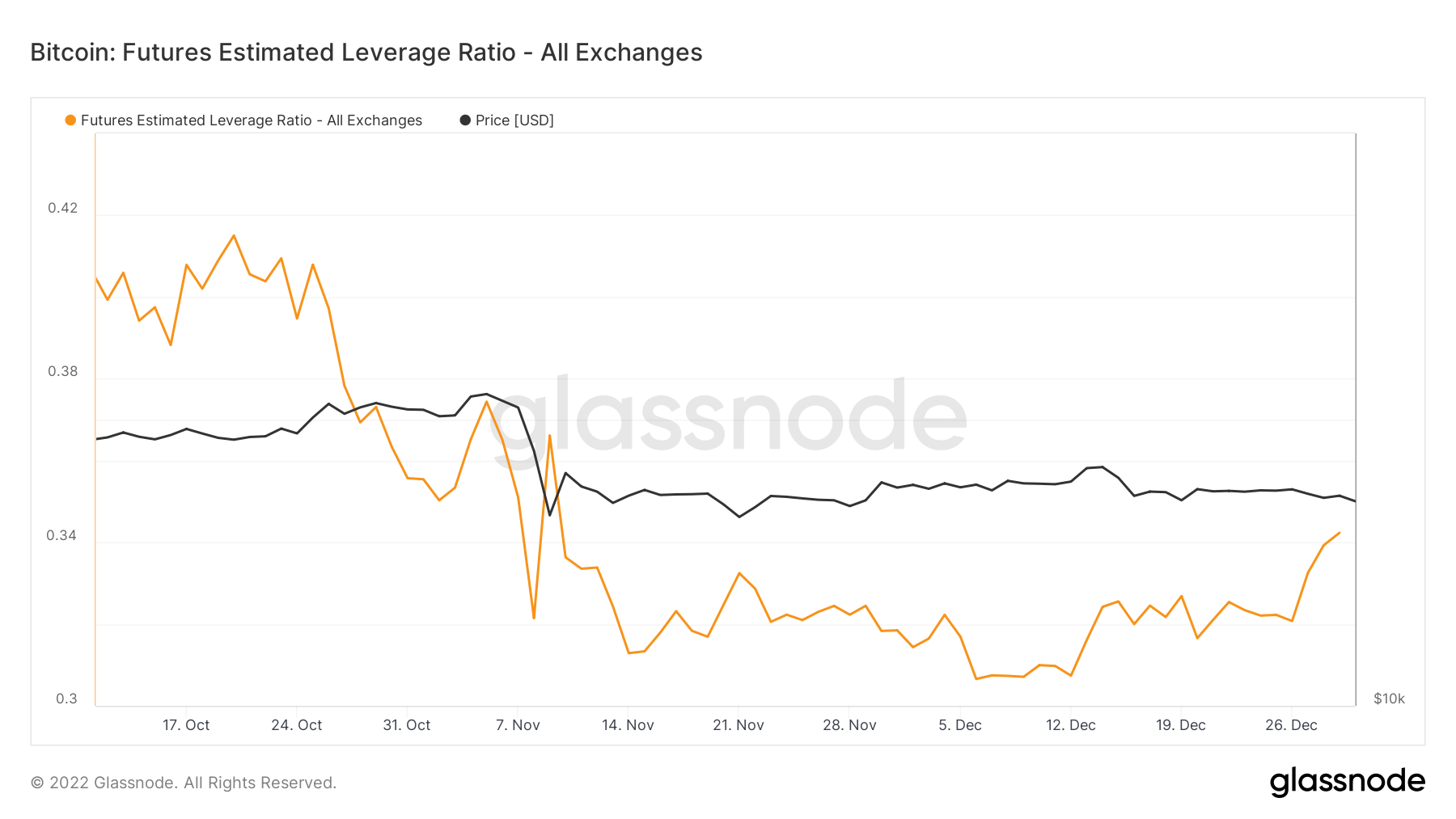

Estimated leverage ratio for futures.

Futures Estimated Leverage Ratio is a measure of the ratio between open interest in a futures contract and the corresponding exchange balance.

The estimated leverage ratio dropped to 0.3 on December 5th after the FTX collapse. However, after December 12th, it began to recover rapidly, increasing by about 10% over 20 days to 0.34 on December 30th.

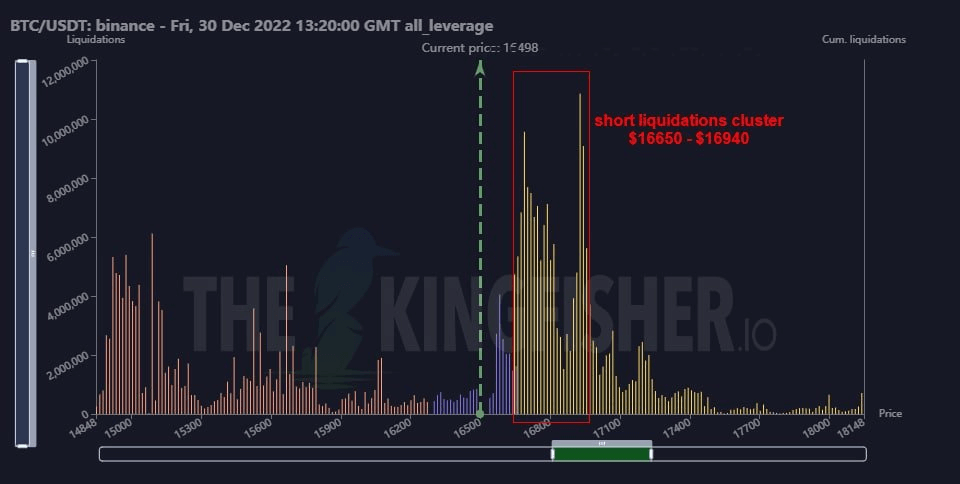

binance liquidation

In addition to the underlying volatility metrics, Binance’s data shows that Binance contributes to price movements.

Binance has formed a short liquidation cluster between $16,650 and $16,940. The current BTC price is hovering around $16,547 at the time of writing, just $100 more to enter the cluster zone.